When the Levee Breaks

Momentum, Threads & Trafficking

Relatively short one this week as I had some long overdue personal business to attend to.

Here’s a reminder to make sure you take the time to focus your energy and attention on what really counts.

Momentum

Momentum in the investment arena can be a slippery concept. Often dismissed by "serious and professional" investors, it's viewed as the unruly counterpart to their more refined strategies.

The discerning, measured approach of veteran investors like Warren Buffett, who champion value investing, contrasts starkly with the seemingly capricious nature of momentum. 'Value' is often considered the antithesis of momentum, with 'growth' serving as a mediating hybrid, bridging the gap by focusing on companies demonstrating substantial earnings or revenue growth.

While value investing, an 'intellectual' pursuit of purchasing companies at prices significantly below their net value, might sound appealing in theory, it's the practical application that poses a challenge. Estimating the intrinsic value of a company and discerning whether the discrepancy between current and 'true' value is temporary or more lasting involves forecasting, which is fraught with uncertainty. Remember the corporate casualties of societal or technological change, like Eastman Kodak, GE, or Compaq Computers?

On the other hand, momentum investing simplifies this process by adopting a more intuitive philosophy - the notion that stocks on the rise will continue their ascent. Indicators like the Relative Strength Index aid momentum investors in pinpointing promising stocks - a physics principle applied to finance, if you will.

Despite its 'unsophisticated' appearance, momentum investing often outshines value and other investment strategies. Prominent figures like John Henry, owner of the Red Sox, have amassed fortunes in the macro markets using this approach.

Simply put, robust stocks tend to become more potent, while weak stocks often dwindle further.

Momentum's success can be attributed to various systemic factors. Money managers often exhibit herd-like behavior, gravitating towards flourishing stocks and shunning the underperformers. At the end of the quarter or year, investors favor seeing their funds in 'winning' stocks, even if they've missed the majority of the upswing. This is why I recently speculated that tech stocks, despite rising headwinds from high rates and inflation, would sustain their strong performance or at least maintain their current levels.

At the end of the 2nd quarter, funds have to release a 13E reports which details their stock holdings. Therefore, you tend to see people piling into the names that did well the last quarter or two - names like tech giants Nvidia, Facebook, Tesla, Microsoft and Apple.

Those names are the companies that have carried the indexes higher over the past 6 months.

They also happen to be the biggest components of the the S&P 500, which is a market weighted index.1 That means 10 stocks or so make up a huge part of the index.

Now that the quarter is over, I expect the slow rollover to begin and for indices and stocks to head lower.

People keep asking me what are the ‘headwinds’ I’m referring to. We speak about topics like this every week in my Alpha360 group. A super-brief synopsis is to think of markets like an airplane - their speed is either helped by tailwinds, or hurt by headwinds.

For the past 40 years, the equity markets have enjoyed substantial tailwinds. The Baby Boomer generation, the wealthiest in history, has served as a robust engine, pouring capital into stock markets during their peak earning years.

Furthermore, we've experienced an unparalleled bond bull market, with interest rates plummeting from 18% in the '80s to virtually 0% today. Low-interest rates foster capital formation, enabling both businesses and individuals to borrow and flourish, thereby fueling sectors like real estate.

Adding to the windfall, China has been instrumental in keeping inflation at bay as the world's manufacturing giant. The global market has also expanded significantly, thanks to the fall of the Soviet Union, leading to a 'peace dividend' as countries redirected defense spending towards modernization.

Sadly, many of those tailwinds haven’t just stalled - they’ve reversed, transforming into significant headwinds.

Interest rates have surged and are at 5.25%, marking their quickest ascent in decades. The average 30 year mortgage is 7.50%. That's a killer for home buyers.

The Fed has made clear they are going “higher for longer”, meaning they will continue to raise interest rates until they feel comfortable about the inflationary crisis we’ve endured since the beginning of the Biden Presidency (a combination of pathetically stupid policies, years of Federal Reserve mismanagement, and a completely unnecessary war in Ukraine we pushed for and have prolonged).

Russia, China and the BRICS nations are actively challenging the U.S. dollar.

The U.S. is $31 trillion in debt and running deficits for as far as the eye can see.

We just had the second largest bank collapse in the U.S. and global superbank names like Credit Suisse needed to be bailed out overseas.

The commercial real estate sector is a well known donut and losses will exceed $2 Trillion dollars.

China and the US are now in a technology war with the US limiting sales of chips and other key technological components to them while China embargoes rare metals that we need to build those chips and electric vehicles.

Moreover, the retiring/dying Boomers are withdrawing money from the stock markets, further straining them to pay for their living expenses. ‘Demographics is destiny’ is a maxim that bears repeating.

All of these are ‘headwinds’ that the US economy and especially stock markets must contend with.

The 3 most important factors for the stock market are:

Earnings

Interest Rates

GDP (Gross Domestic Product)

These 3 factors carry the most weight over time and should dictate the direction of the market not accounting for exogenous shocks (pandemic, 9/11, nuclear war, aliens, etc).

Right now, none of them are working in our favor.

Interest rates, instead of being accommodative, are high and expected to rise further. Earnings have begun to dwindle, a first in a decade (excluding the pandemic shock year). The GDP, too, is feeble, indicating a looming recession.

Sure there are lots of secondary and tertiary factors....commercial real estate and bank collapses. The war in Ukraine. Market sentiment a big one. Employment (still strong).

But those 3 factors above carry the most weight when forecasting stock performance.

It’s still a Tale of Two Economies as we've spoken about before. The top 10% are remarkably well off, and spending like crazy on travel, entertainment and luxury good.

The rest of the country is taking second jobs in order to deal with crushing inflation and wages that can’t keep up.

To get an idea how expensive the market is, take a look at the Shiller PE.

The Shiller PE, named after economist Robert Shiller who famously called the housing bubble, gives you a longer-term view that corrects for short-term volatility,

The formula for the Shiller P/E ratio is simple: current price divided by average inflation-adjusted 10-year EPS.

To do that, you’ll need to find an index’s EPS for each of 10 years, adjust each for inflation to bring it into current dollars and find their average. You’ll then divide the index’s current price by this average.

Today’s market trades at a Shiller PE of 31x, above the levels it was at during both Black Tuesday and far above its levels during Black Monday. It’s also about 10% higher than its level during the 2008 crisis.

For comparison, the Shiller PE is now at about twice its median of 15.93x and almost twice its mean of 17.03x.

Here’s a link if you want to see the charts for yourself.

https://www.multpl.com/shiller-pe

What does this mean for me/you? It means the market is very richly priced. When you take into account all the significant headwinds and an overpriced market, it is highly unlikely the market will provide decent returns over the next 3-5 years.

That doesn’t mean that individual companies and stocks can’t outperform and do well, but the stock market itself, the indices like the S&P 500, Dow Jones and Nasdaq should struggle or tread water over the next few years (unless the Fed goes back to printing money mode).

Passive index investing like that offered by Vanguard is not where you want to put your money for the next few years.

Next week I’ll give you a few ideas and options.

Blow the Whistle

Momentum works in different sectors as well. After all, the basic underpinning is physics. Inertia - An object in motion tends to stay in motion. An object at rest tends to stay there.

Whistleblowing is another great case study for momentum.

For years, people were afraid to come forward and reveal what they’d seen in the dark corners and back rooms of Washington DC. Whether it was stories of Hillary’s body count, or watching the FBI and media destroy anyone that bucked the official narrative, the decision to blow the whistle on bad actors carries tremendous personal and reputational risk. It equates to committing suicide on your previous life (sometimes literally) and making the difficult to decision to put country and honesty above personal gain or comfort.

The last month or two has seen the dam beginning to break. One whistleblower brings forth 4 more. 4 bring 40. The Doomsday clock for Biden and his family of criminals and apparatchiks is approaching midnight.

Patriots are beginning to come out of the woodwork to drive the stake in these corrupt vampires. Recently we’ve seen:

1. Gary Shapley - IRS whistleblower

2. 2nd IRS whistleblower

3. House Committee FD-1023 whistleblower

4. Other undisclosed House Oversight witnesses

5. Two dozen FBI whistleblowers

What we know for sure, is that our law enforcement and intelligence community is deeply corrupt…and they’ve been working for years to protect and suppress criminal activity of one of their own corrupt scumbags. That dam is finally breaking. Fingers crossed the momentum continues…

And now the NY Post’s Miranda Devine reports (the same woman who broke the Hunter Laptop story that was suppressed by the FBI and intelligence community) on Dr. Gal Luft.

In a remarkable turn of events, Dr. Gal Luft, an Israeli professor and the elusive "missing witness" in the corruption probe involving the Biden family, has dropped some serious allegations. He accuses the Bidens of accepting bribes from entities connected to Chinese military intelligence, and furthermore, utilizing an FBI informant codenamed "One Eye" to disseminate classified data to CEFC China Energy.

A video exclusive to @mirandadevine at The Post features Luft claiming that during a clandestine meeting in Brussels in March 2019, he delivered damning evidence to a sextet of officials from the FBI and Department of Justice. However, he insists this explosive information was subsequently buried.

Luft narrates how he proactively notified the U.S. government about a possible security breach and compromising material concerning Joe Biden, who was then a presidential aspirant.

Yet, rather than being hailed as a whistleblower, Luft alleges he has ironically become the target of those he initially sought to inform.

Luft's recent arrest in Cyprus, he asserts, was a calculated move to hinder him from testifying about the alleged corruption within the Biden family to the House Oversight Committee.

He vehemently denies allegations of arms dealing, asserting emphatically, "I have never traded a bullet in my entire life."

Adding weight to his defence, he states, "nowhere in my indictment has the DOJ claimed or presented evidence that I bought, sold, shipped, or financed any weapons."

Luft's narrative takes a more intriguing turn as he alleges that Joe Biden, in the aftermath of his vice-presidential term, attended a meeting at the Four Seasons Hotel in Washington, D.C., flanked by his son Hunter and representatives from CEFC.

His account of the meeting, Luft alleges, was subsequently substantiated when the notorious laptop belonging to Hunter Biden, a trove of emails and receipts, was handed over to the FBI.

Luft's tale thickens as he claims CEFC compensated Hunter to the tune of $100,000 monthly and his uncle, Jim Biden, $65,000, in return for their influential networks and the use of the Biden name to globally market China's Belt and Road Initiative.

Luft refutes the notion of acting as an unregistered foreign agent, questioning why he faces indictment for ghostwriting a seemingly harmless article devoid of any monetary remuneration, while the Bidens' alleged facilitation of foreign governmental interests goes unaddressed.

"Why does the mother of all FARA cases, which involves the Biden's alleged systematic influence peddling on behalf of foreign governments raking in millions, go unpunished?" he questions.

In a bold move, Luft challenges the government to reveal the transcripts of the Brussels meeting and disclose the evidence lodged against him.

This is a MUST watch.

Mockingbird Media Runs Cover for Pedos and Child Trafficking

Back to whistleblowing, I expect there to be plenty coming forward regarding child trafficking and pedophilia in the two main criminal deviant subsets: Hollywood and Washington DC.

For years, those in power have abused their positions. Not just with young women hoping to ‘make it’, as Harvey Weinstein and the #MeToo movement showed us, but in deeper, darker ways.

Child trafficking, pedophilia and rape are rampant in both Hollywood and DC, not to mention the rest of the country and globe.

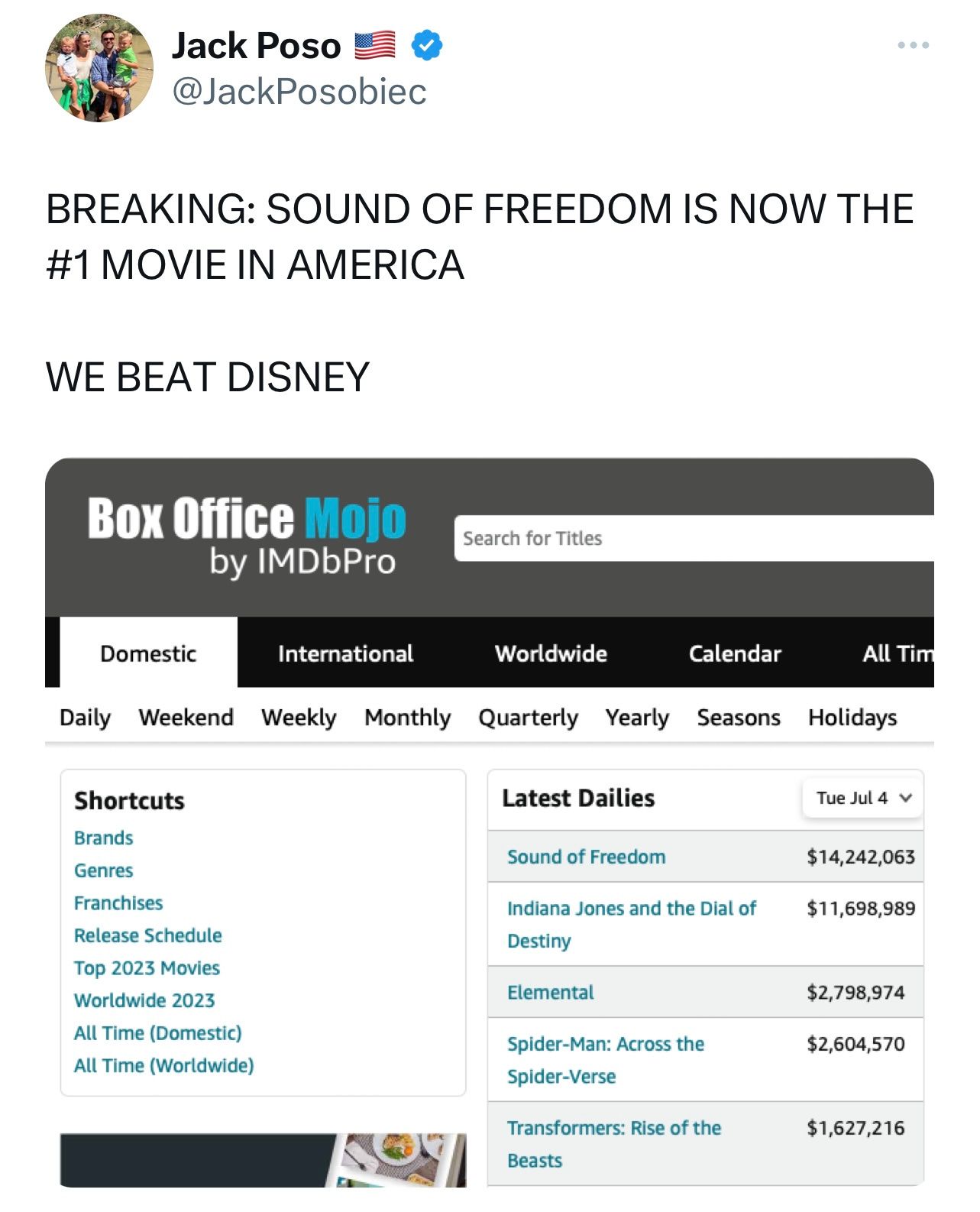

Last week I wrote about Sound of Freedom, an amazing independent production by Angel Studios, Eduardo Verastegui, and starring Jim Caviezel that has vaulted to the #1 movie in America with its box office surpassing big budget studio tentpoles like Disney’s woke geriatric CGI release, Indiana Jones.

The details and perpetuation of this tragic underbelly have been suppressed and hidden from the public for years (perhaps centuries).

The world can be an ugly place. The followers of Moloch believe in two cardinal rules: children are a worthy sacrifice, and the rules don’t apply to them.

Two events came into the public domain this week and hopefully began the long road to opening some eyes and taking the battle against child trafficking to another level.

The first, as disgusting as it is, was no shock.

The media ran hit piece after hit piece on Sound of Freedom likening it to a Qanon conspiracy fest’.

Rolling Stone and the Washington Post, which both gushed over Netflix produced pro-pedophilia movie, “Cuties”, was swift in their criticism.

Is it any surprise that the deviants at Disney, Netflix and Amazon turned the movie down?

Anyone who has looked at the issue of child sex slavery knows it’s real, tragic and disgusting.

The global sex trade (of which over 50% are minors) is the fastest growing form of commerce, worth $32 billion annually. In fact, human trafficking is the fastest growing area of organized crime and the third largest income revenue for organized crime after narcotics and arms sales. What makes this business unique is that women and girls sold into sex trafficking earn profits for their pimps and traffickers over a great number of years, unlike the profits earned from drugs and narcotics that are sold and used only once.

The horrifying part is how many of our political, entertainment and business ‘leaders’ are involved.

Bill Clinton and Bill Gates took multiple trips to Epstein Island.

Speaking of the sex dungeons and child rape halls in the most famous child rape case of all time, where is the Epstein client list?

How is it possible the most famous pedophile child trafficker and his assistant Ghislaine Maxwell were both sentenced to life in prison for child sex trafficking yet not a single client has been revealed?

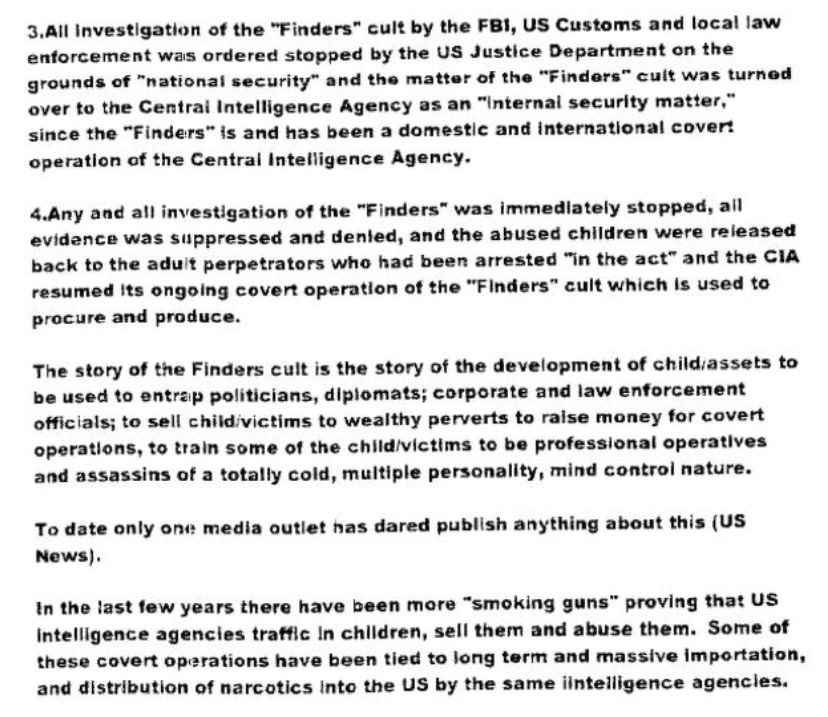

The second major swamp story released this week was that the CIA was running an organization called “The Finders” that kidnapped children from daycares, locked them in cages on a farm in Virginia, subjected them to satanic ritual abuse, had them participate in orgies, blood rituals, and the sacrifice of other children, and then sold them as sex slaves overseas. The FBI discovered this during an investigation. What did they do? Covered it up.

https://vault.fbi.gov/the-finders

https://www.tallahassee.com/story/news/local/state/2019/10/29/fbi-vault-the-finders-conspiracy-theories-florida-tallahassee-child-abuse-case-files/2487934001/

Quote from the FBI files: “Specially trained Government Kidnappers with Top Clearance and protection in their assigned task of stealing children, torturing and sexually abusing them...involving them in satanic orgies, bloody rituals, and murder of other children..”

If you can still possibly think after the soft coup better known as the Russian Collusion Hoax, the Hunter Laptop coverup and Covid, that our government is the ‘good guys’ and trying to help the average person…well, I’ve got a bridge to sell you.

I love my country. I despise my government.

Until we disband and recreate most of the existing legacy structures and institutions (not bc of racism or any other patriarchal, white supremacy nonsense; but because they are death cults that worship Moloch and abuse their power every chance they get), it’s hard to be optimistic.

Truth is akin to a relentless river, difficult to suppress or contain. When such unvarnished truth eventually seeps into the public consciousness, thanks to the valiant endeavors of whistleblowers, champions of freedom, and grassroots journalists, the established barriers topple dramatically.

When the proverbial levee breaks, you better have a plan in place. Because the world that emerges from this transformative cascade will bear little resemblance to the world we once knew.

Threads…Zuck and Meta Take on Twitter

Intelligence community eunuch and censor-in-chief Mark Zuckerberg rolled out his long awaited Threads app this week.

The media breathlessly reported on Threads gaining nearly 50 million users overnight.

For those involved in entrepreneurship and venture capital, I have spent the past week dissecting how Zuckerberg managed to successfully navigate his venture (aided, in no small part, by media outlets that are staunchly pro-regime and decidedly against Musk, given his unwavering support for free speech and opposition to censorship - the age-old maxim "the enemy of my enemy is my friend" comes to mind). I have managed to condense my insights into a concise analysis, which I hope will prove insightful for those considering initiating or investing in a startup in the future.

Here’s his secret sauce.

Start with 2 billion users.

Automatically install and market a new, free side app to the current app to all your users.

That’s it. Hope you found this helpful.

And here’s to Threads failing miserably.

Twitter has a lot of issues (top of the list is throttling my account…), but since Musk took over they’ve shown a bold and courageous commitment to free speech which no other app can claim.

Without Musk’s heroic efforts, Biden and his water carrying Regime journalists would still be telling you masks work, the Covid vaccines are safe and effective, the Hunter Laptop was Russian disinformation and that Russia blew up the Nordsteam pipeline.

On the Zuck front, one of the chief government lackeys and censors of critical information knew the so-called ‘vaccines’ were experimental gene therapies that had never been tried before or could potentially cause significant long term damage. This is Nuremberg 2.0 stuff.

Here’s the link to the tweet and the video itself. Just unreal.

China Fights Back with Export Controls

This week, the ongoing technology tug-of-war between the US and China escalated with Beijing's decision to enforce export restrictions on two pivotal metals vital for the semiconductor, telecommunications, and electric vehicle industries.

The controls were a response to US efforts to limit semiconductor chips and other technologies from export to China that would help them in their quest for AI supremacy in technology domains, such as quantum computing, artificial intelligence, and chip fabrication. Conversely, the US has been fortifying its defenses, deploying tools like blacklists and export controls to stifle China's advancements in these sectors.

While the telecom and electric vehicle industries are interesting, they pale in importance behind the AI arms race. While the original ‘moon race’ against Russia was important for psychological reasons in the Cold War with the Soviet Union, the AI race towards Artificial General Intelligence is more of an existential race for China. It is likely the only way they can overcome their economic and demographic issues and successfully ‘beat’ the US. If China were to be the first to develop a comprehensive AGI, that supersentient intelligence would lead to China becoming the dominant superpower on Earth (think a superintelligence 1000x smarter than humanity unleashed by China to destroy our economy, cripple our infrastructure and create new and powerful technologies to power China’s economic might).

Interestingly, the announcement about the curtailment of gallium and germanium exports surfaced just as US Treasury Secretary Janet Yellen was preparing for her journey to China. Her mission? To identify potential convergence points amidst diverging views on topics ranging from Taiwan to trade.

During her interaction with Chinese Premier Li Qiang, Yellen emphasized that the competition between the globe's economic powerhouses is not a 'winner-takes-all' scenario. Li, on the other hand, expressed hope, conveying to Yellen his belief in an eventual 'rainbow' over bilateral relations.

Nevertheless, China's export licensing system for gallium and germanium serves as a stark reminder of its stronghold over global production. However, this move may come with unintended consequences. Should Beijing decide to leverage these rules to limit the shipment of these metals, it would probably lead to a surge in prices, potentially incentivizing increased production in other countries such as Japan, Canada, or the US. But that’s a decade long pivot, and the short term would be rocky to say the least.

Citizen Journalists Stop World War 3 and a Nuclear Accident…For Now

For those who have been following the Ukraine fiasco and the insane amount of state sponsored propaganda the US and their friends in the media and online dump on the American public on a daily basis, you’re probably familiar with the absurd story of the Zaporizhzhia nuclear power plant.

For those not following, Russia has occupied the plant inside of Ukraine and the Ukrainian/US mouthpieces have been loudly banging the drum that Russia was about to blow up the plant, thus flooding the Russian occupied part of Ukraine with radioactive material and triggering a pre-planned escalation of the war by neocon warmonger Senators like Lindsey Graham and Richard Blumenthal.

Just the week prior, Graham and Blumenthal made a trip to Ukraine and with Congress’ permission, stated that any nuclear accident would trigger Article 5 and allow Nato and the US to intervene in the war. Graham and others keep pushing for Ukraine admittance to NATO, one of the chief reasons for the war in the first place.

As Ukraine is badly losing and on the verge of defeat, Zelensky, Biden and the US intelligence community were willing to risk a nuclear accident and further devastating escalation by blowing up the plant themselves, just as they did with the Nord Stream pipeline and the Karkhova Dam.

Biden has already admitted what any rational person can see - we are closer to a nuclear exchange and war at any time since World War 2. The Cuban Missile Crisis was a junior prom compared to this.

Fortunately for us, citizen journalists moved in to highlight this planned ‘false flag’.

Here’s what the timetable looked like courtesy of @WarClandestine, a citizen journalist on Twitter.

June 21-30: Ukraine ramped up rhetoric that Russia had plans to sabotage ZNPP.

July 1-4: Massive external scraping on Twitter causing Elon to limit user views.

July 6: Ukraine claims threat of ZNPP sabotage is no more.

I think Western Intelligence were using AI to scrape social media to gauge public perception of the ZNPP/Ukraine, to see if the public were buying their Russian sabotage psyop.

What they found was that the public logically pieced together that Ukraine/Deep State are the ones who benefit from the potential sabotage, as their goal is to convince NATO to takeover the war and drag the US directly into conflict with Russia, because the counter-offensive was a catastrophe and the Ukrainian military failed.

Nobody was buying Zelensky’s claims. Even the IAEA went out of their way to tell us that these claims of Russian-planted explosives were unverified.

I think Western Intelligence saw that the public were not buying their psyop attempt, and AI judged that they couldn’t successfully pull it off because the data they scraped showed that the public were too keen to their plot. Thus Budanov claiming the threat has magically disappeared.

In other words, I think public awareness might have just prevented Chernobyl 2.0.

Regardless of if this is what actually happened or not, one thing is for certain; citizen journalists are dominating in the Information War right now. We are taking Western propaganda and dismantling it in quick succession. The enemy have lost their stranglehold on the narrative and thus public perception.

We are winning.

As I joked on Twitter earlier in the week, Zaporizhzhia translated means ‘Gulf of Tonkin’.

What I’m Reading and Watching…

Silo on Apple TV. If you like dystopian science fiction (guilty as charged), this is a well done series.

https://www.wmbriggs.com/post/47404/

Best of Tweeter

Memetic Warfare

Parting Words

That’s it for this week folks. Hope you enjoyed!

A capitalization-weighted, or market weighted index is an index construction methodology where individual components are weighted according to their relative total market capitalization.

The components with higher market caps carry greater percentage weights in the index. Conversely, the components with smaller market caps have lower weightings in the index.