Man….I need to stop writing this newsletter during the week and just wait until Saturday. Why? Because as I mentioned last week, things are moving so fast and so chaotically that by the time I get to Saturday we’ve already got 2 or 3 new ground shaking stories that render obsolete everything I’ve written the previous 72 hours.

So a finished newsletter ready to send to the printers on Friday AM (or at least the digital equivalent of an email scheduled for Sunday AM) is now semi-obsolete 24 hours later.

In this case, a deeper look at SVB and the banking crisis along with a few other stories of note became - “And oh yeah, btw, they’re arresting the former President of the United States and front runner for the 2024 election, plus the biggest banking failure in history is going down in Europe as well.

If there was an antithesis video to the video above, I’d play that for you now.

Because I can bet you, most of us and definitely all of them aren’t ready. Sovereign Sunday first principles coalesce around becoming the best version of yourself.

It’s critical to be the best version of you so that you can help protect, provide and preside over your family and successfully navigate the difficult times ahead.

In a Godless, aimless world, discipline and faith are superpowers.

Remember, no one is coming to save you; ergo it’s up to you to be prepared, resilient and sovereign and to build relationships and networks with likeminded people. The ‘Aligned Apes together Strong’ mantra will keep us ready and fortified for the battles ahead.

Despite an uncertain future, with courage, determination and faith, we will not only survive, but we will prosper.

Nevertheless, it’s important as an analyst to know what’s coming our way…to be able to assess and game the battlefield. In this case, it’s mostly an informational battlefield.

However, when the side in power starts to lose badly enough, the impetus is to slip into live, kinetic fire and potential false flags to divert attention from their failures and the discovery of their schemes.

Now that the truth about Covid, the ‘vaccines’, the Biden’s Chinese and Ukraine corruption, J6 and so many other putrid events are finally coming out, you’re going to see the regime pull out all stops in order to stop the truth and to attack those unwilling to comply with their false narrative.

Pay close attention and prepare for what’s to come. If you’ve read this newsletter or my other writings or group teachings for the past 3 years, you’ve been expecting much of what we are seeing and about to see. The old regime is crumbling, and will do anything to hold onto power. Whether that means crashing the banks, starting WW3, releasing another virus, or a cyberattack that knocks out the electrical grid for weeks, have your Game Plan in place.

Shelter

Water

Food

Power

Medicine

Cash & Barter items (cigarettes, medicine, liquor, etc)

Defensive Options

A network of aligned individuals nearby you can lean on and force multiply.

And most importantly, remain optimistic. Those who operate without conscience may appear to have an advantage in resources and reach because they control the media and avenues of distribution, but the world is still dominated by good people with positive intentions.

Life will always be about about risks, challenges and obstacles. While there was a brief time from 1985-2000 where mostly peace reigned and the world was growing….that was the exception rather than the norm.

Tuning out the day to day noise from our corrupt and bought media, there are 3 main risks I’ve written about incessantly that need to be addressed.

The first and key to all of the others is holding accountable the Deep State & Covid Architects, who are one and the same. These are the elite, shadow structures that rule our country and much of the broader globe. The fabled Powers That Be, the Cathedral, the Deep State or any other appellation you want to give to the entrenched National Security State and permanent Uniparty government that operates in the shadows and above the law. Their power is enhanced by the Federal Bureaucracy/Administrative State and their handpicked hens in the media who run with whatever narrative those in charge want to push, truthful or not.

These vampires operate on basic acquisitive principles of “More control, more power, more money” while simultaneously embracing the 3 Ds of ‘depopulate, demean and demoralize’ the population.

You and I are mere plebs and serfs . We will eat the bugs, own nothing and be happy. Meanwhile, the elites will dwell in Elysium and imbibe young girls and old wines.

These people need to be flushed out in the open and held accountable for their crimes. It’s the only way we can move forward as a “free and open” society. The damage they’ve done is tremendous, and it may not be repairable.

The second mega-challenge is our warmongering and diplomatic mistake in Ukraine. We’re rapidly approaching a cliff that we largely created.

The Intelligence Community (again, Deep State) and others have unleashed a network swarm of easily programmable people and hundreds of thousands of bots to tell a very, dangerous narrative. While Putin’s military response to our antagonisms should be condemned, it avoids the ugly truth that we bear a large responsibility for the conflict…and Zelensky does now too for not negotiating a peace agreement.

Crimea is Russia’s, as per the election referendum and parts of Donbas should fall under a special UN zone or Russian control as well since the population identifies as and sympathizes with Russia. Ukraine (or at least the Ukraine puppet we installed in 2014 as part of a CIA coup) spent years unleashing their Nazi forces to commit atrocities in this region. As far as I’m concerned, they’ve forfeited their right to this area.

Peace was always possible, but we goaded Russia into a corner for our own reckless geopolitical chess game byway of threats of NATO expansion.

The end game is simple and sure beats nuclear holocaust.

No NATO expansion.

Crimea not on the table. It’s Russian.

And Donbas region to Russia or a neutral zone.

Peace tomorrow.

That’s certainly better than every last Ukrainian dying and risk of nuclear war which is where it’s heading. That’s where we’d already be if the truth was allowed to come out and the media didn’t spend the last year lying to the gullible sheep in America that Russia was losing badly and on the brink of bankruptcy.

If Zelensky wants to be a leader, preserve what’s left of your population and future rather than taking marching orders from your US ‘allies’.

It’s an ugly compromise, as Russia’s invasion was a gross transgression of diplomatic norms, but it should’ve been avoided. I’m sure the attitude here at home would be a bit different if say China agreed to a defense pact with Mexico and started massing it’s forces on the Texas, Arizona and California border.

War is the failure of diplomacy and the US ‘purposely’ failed that diplomacy as the goal all along has been twofold - fight a proxy war against Russia and bring Europe under our control/dependence for energy.

The third mega-challenge is right here, right now. It is the neverending banking and financial crisis that we’ve been trying to navigate since 2020 (ahem, 1998).

This letter’s long enough as is, so I’m not going to go deep into it here but the Cliffs Notes version is this catastrophe is entirely a failure of public policy and of our own making. The video below is a good place to start if you want more information how our easy money policies and lack of political leadership put us down this portentous path.

The notes below on Credit Suisse and the banking crisis offer additional insights.

Credit Suisse is not Lehman - it’s bigger

While watching my son play a tennis match Friday night (these days based on my age and sobriety, I’ll take it everyday and twice on Sunday over spending St. Patricks Day in the city dodging fists and vomit from amateurs…in fact, I’m with Chris Moltisanti on this one…), I was treated to the news that Credit Suisse was a zero. The release didn’t quite say that yet, but it’s been obvious all week (and building for more than a year) that this was inevitable.

If there’s one thing evident in today’s house of cards held together by duct tape gorilla glue, it’s two maxims that I’ve cited on more than one occasion in this newsletter.

The first maxim is, where there’s smoke there’s fire.

Our financial system after 25 years of manipulation and easy money, is at best a Walmart version of Squid Game meets Survivor. There are only a limited number of immunity idols and passes to the next round, and a lot of entities circling a small number of chairs while the music is still playing.

Last month it was Civilizational Jenga as the Biden Administration flirted with nuclear war by escalating in Ukraine.

This month, it’s time for Financial System Jenga!

And with the exception of a handful of TBTF banks and GSIBs (Global Systemically Important Banks) like Citigroup, JPM, Wells Fargo and Bank of America, the rest of the field are out there playing a real life Hunger Games simulation with their fate resting almost entirely in the hands of the central bankers and corrupt political actors that created this meltdown in the first place.

In a healthy economy, health financial system and healthy political system, when you see smoke, there’s a chance the firefighters can arrive and put the fire out before it causes much damage.

Sadly, we are currently living through the opposite scenario - endemic corruption and incompetence at every institution and level of government so even the smallest grease fire means the whole damn house is coming down.

So any smoke whatsoever is a clear signal to hit the exits.

Which brings us to Maxim #2.

He who panics first, panics best. Whether it was SVB, Silvergate or Credit Suisse, at the first sign of smoke it was time to go ‘Hey Kool-Aid’ through the exit doors. You may have broken a leg or arm in the process, but at least you’d live to fight another day.

In Credit Suisse’s case, there have been numerous smoke signals and persistent rumors have plagued them and Deutsche Bank for the last few years (btw, Deutsche Bank is next).

In October 2022, the Federal Reserve ‘loaned’ the Swiss National Bank $10B which was primarily used by Credit Suisse for liquidity. Healthy banks don’t need a $10B injection by the Central Bank for shits and giggles.

There was also the Greensill and Archigos scandals which severely weakened Credit Suisse’s credibility and balance sheet.

The steady and accelerating exodus of deposits even after this injection in October was another sign CS was entering the toilet bowl swirl as Mr. Sandman entered the chat and they were, “Off to never never land.”

The final straw came last Friday as the Swiss National Bank came to the rescue again. This time, with a $54B rescue package plus commitment to additional measures.

While CS’s share price rallied briefly, the real tell is always the credit markets (fairly or not, the credit market is considered ‘smart money’ while the equity side is considered 'less smart’ - the moniker ‘dumb money’ is saved for the retail customers who get the short end of the research and investing stick every time).

In this case, CS’s credit default swaps (CDSs)1 didn’t rally at all and stayed at a level that signaled the patient was terminal. For example, Credit Suisse’s CDSs are trading at twice the levels (no bueno) that Lehman’s CDSs traded at before they went under during the Great Financial Crisis.

While Credit Suisse is perhaps a well capitalized bank on paper after the recent injection, the key danger (and a self-fulfilling prophecy when CDSs trade at the levels noted above) is that depositors continue to withdraw money as a precaution.

Additionally, a situation arises similar to that experienced by well-capitalized banks during the 2008 financial crisis, where customers were reluctant to deal with financial institutions for fear of a domino effect and counterparty risk. In other words, if I’m Morgan Stanley, am I really going to enter into a contract or deal with CS (even if lucrative for both parties) where it’s uncertain that CS will exist in a month and be able to honor their contractual obligations? I don’t know. But I’m not in the mood to risk my own capital or bank to find out. So CS finds itself shut out of certain markets, lending lines and other lines of business they rely on for their day to day business. This, is the self-fulfilling prophecy brought on by a lack of confidence.

In the end, it’s likely UBS or some other European behemoth will absorb the Credit Suisse carcass in a deal reminiscent of JPM and Bear Stearns (with plenty of Swiss Central Bank quiet guarantees).

Which bring us to Maxim #3.

In finance, confidence is paramount.

So What Does it All Mean for the Financial Sector

Well, that’s the $64K question ($875K with inflation). What does the failure of Silvergate, Silicon Valley Bank and Signature mean and now Credit Suisse on top of it all?

It begs two very serious questions.

What does it mean for my money and are my deposits safe? I attempted to answer that last week. It’s sad, but if you’ve got your money in a small bank and it’s more than $250K, your money might not be protected. While it’s likely this week the Fed moves to some kind of explicit system wide deposit guarantee in an attempt to stave off further contagion, right now that guarantee is only implicit. Only if the bank where your money is held is deemed systemically important will you be offered the same safety assurances as SVB’s depositors received last week.

Here’s Congressmen Larmer grilling TreasSec Yellen on that very question. Note her evasive answer. And someone please tell me why we have people in their 70s running everything? Every study in the world confirms that cognitive decline starts to accelerate at this age so….just saying.

So, spread your money if greater than $250K or put it at a TBTF bank….

The second question, is what does this mean for the overall financial system? And more immediately, are the Feds actions with regard to SVB going to be inflationary or deflationary?

Remember, the Fed’s hands are somewhat tied due to the record high inflation the Fed, Trump and Biden created with their idiotic and democidal response to Covid.

During the GFC, inflation was at less than 2% so there was some wiggle room to print and bailout without worrying about igniting an inflationary spiral.

Those favorable macro conditions don’t exist now. We’ve got the worst inflationary crisis in our nation’s history which the Walking White House Corpse makes worse with every move he makes.

Inflation has been slow to come down even with the most aggressive rate hike campaign in recent history (the same campaign ironically that has made these banks lose tons of money as the decline in bond prices due to the hikes has created close to a trillion dollars in balance sheet holes at the banks.

The consensus on FinTwit (financial twitter) is that the Fed’s recent actions are quantitative easing (QE) and will add trillions in liquidity. That’s one reason we’ve seen some high beta markets rally like tech and bitcoin. I could be wrong, but I do NOT see it that way, and I am definitely in the minority on this opinion.

I don’t believe the Fed and FDIC loans being offered are QE or explicitly inflationary. We have a liquidity crisis, a solvency crisis and that reads as much more deflationary to me (or at worst, neutral since the Fed will likely take additional future measures to preserve the banking system).

The extraordinary Fed measures (we might as well call every move ‘extraordinary’ since 2008 they’ve been juggling chainsaws trying to kick the can down the road until time or technology can give them and out) known as the BTFP and other recent moves are at best neutral, or possibly even maintaining a tightening bias.

The Fed isn’t printing new money and these aren’t giveaway loans - they come with fairly punitive interest rates (Fed funds + 10bps or approximately 4.75% short term loans (1 year max) that must be paid back. If they aren’t paid back, a lot of these banks may lose their equity and independence. That’s assuming the Fed sticks to its articulated plan. There’s a good chance that 12 months from now if the entire banking system is still teetering that the Fed will extend or forgive the loans, much like the PPP loans were forgiven if used for their stated purposes.

But as an investor or depositor, I wouldn’t risk my hard earned capital on the Fed turning soft - especially not with inflation still running hot. In fact, these loans may be the Fed’s short term method to prop up the banks so the Fed can continue to either raise rates or keep them high to stamp out inflation.

As I’ve written before, there are only two paths right now for the Fed going forward, neither of them attractive.

The Fed can give up on it’s battle against inflation to preserve the solvency of banks and keep the economy growing or the Fed can stomp out inflation and risk a nasty, deflationary spiral which sends the economy into a hard recession.

It’s the proverbial rock and a hard place.

In the end, it’s likely the Fed gives up the inflation fight early and revises their 2% inflation target to 3 or 4% (the seeds are already being sown in various articles and think tank pieces) and hopes the labor market weakens and inflation trends down while the economy sputters along at slow growth.

This will also help lessen the debt burden (now standing at somewhere between $30 Trillion and $150 Trillion (off balance sheet liabilities like Social Security, Medicare, pensions, etc). The reality is that debt can never be paid down, we can only hope to outgrow it over a decade or more of decent growth with semi-low inflation. It’s akin to throwing a football through a moving tire at 50 yards - not impossible, but very low odds even with an Aaron Rodgers or John Elway at QB.

There are a dozen or more other serious variables at work during all of this. The War in Ukraine, a potential National Divorce, the arrest of a President, and a BRICS bloc competing currency (gold, oil, bitcoin and local currency backed anyone?) for starters.

The bottom line here is we are once again in unprecedented waters, and the odds of things getting more chaotic and turbulent quickly are likely. Here lie Dragons, and we don’t have a dragonslayer anywhere in site.

If any of the above financial commentary is confusing or reads like Greek to you, consider signing up for Alpha360 Foundations. It’s my private group coaching service where I gave you everything you need to understand money, markets and investing with an added dose of self-mastery and sensemaking. In light of the financial madness we are facing, I’m offering 40% off the monthly membership rate this week. Email me for the code or connect in the chat.

Balaji Comes Out Swinging

Balaji Srinivasan, author of the Network State and one of the Greatest Minds of Our Time had a big Saturday.

Balaji is sort of the anti-Yuval Harari. He believes in the power of decentralization, people and freedom….and therefore, Bitcoin. If you weren’t quite sure how much Balaji believes in Bitcoin, he set the record straight by pulling his you know what out and flopping it on the Twitter Table over the weekend.

In response to James Medlock’s offer to bet anyone $1 million dollars that the US would NOT enter hyperinflation, Balaji publicly responded:

Now before you start high fiving your crypto bros and buying BTC at 10 to 1 leverage on Binance, let me offer my two cents on what I think is happening here as I don’t think (and f’n hope) BTC does NOT go to $1 million dollars in the next 90 days.

Because if it does, I’d much rather have ammo, food, medicine and a nice shack in the Adirondacks than most of my money in BTC as the collateral damage would be immense.

Balaji isn't stupid (although this bet is stupid if the average person offered the same bet under those terms). In fact, he's probably one of the brightest guys out there (again, which doesn't mean he knows how to trade or manage money either. Plenty of geniuses can’t trade their way out of a paper bag).

Two thoughts why this bet makes sense for him.

One, he's really just trying to make Medlock have some real skin in the game. The flip side of the original bet as it's structured was Medlock bet $1M the United States would not hit 'hyperinflation'. This is a fairly obvious, 'Heads I win, tails you lose' bet.

If the US does not hit hyperinflation, Medlock gets $1M dollars. If the US does hit hyperinflation, he'll have to pay $1M dollars (but that million will be in a rapidly devaluing currency due to the hyperinflation so it might only be actually worth $100K (or less). 2

The real devil is in the details as they say. How do you define 'hyperinflation' and what would constitute it? 50% y/oy CPI growth? 100%? 1000%? Is CPI even the right measure knowing how it’s distorted by the government?

Balaji's counteroffer is clever because he likely already owns several thousand BTC (based on his past work with Coinbase and length of time in the sector). If he doesn't already own BTC, he can purchase 1000 call options on BTC with a $25 strike price prior to making the offer he made.3

Again, the devil is in the details so what actual number would constitute hyperinflation in the next 90 days? Frankly, even if the banking crisis really derails the system, it's unlikely you see hyperinflation in that quick of a time period. Lag is usually 12-18 months with monetary policy (early 2020 PrintFest showed up in inflation by end of 2021).

Either way, if Balaji loses, his bet is a fantastic marketing ploy for BTC and will likely push added attention, hedge buying against banking system disaster, and short covering that has already driven BTC from $24K or so up to $27K and change (and conveniently thru 50 and 200 day moving average overhead resistance).

If he can get $5-10$ out of his 'BET', he will make $5M - $25M (or more) potentially off his existing BTC stash (or call options purchased) and will therefore benefit either way.

Alternatively, he could just be an altruist and has $1M to throw away to raise awareness of BTC which is certainly a better way to do it than any of the Super Bowl crypto commercials we saw where firms paid $7M for 30 second commercial exposure...

They Got Saddam!

No wait, it’s just Trump. Negotiating terms with the Secret Service for President Donald Trump’s arrest this Tuesday by Manhattan District Attorney Alvin Bragg is the latest ‘X Factor’ that came out Friday evening.

While the conversation around a National Divorce is slowly moving from the laughing stage to the negotiation and implementation stage, the Left announced the least surprising bombshell of all for those who have been paying attention.

This is likely just the first of 3 indictments, with the two remaining being Georgia (for an attempt to overturn the election in that State) and a Federal indictment for the mysterious classified docs at Mar Lago that everyone stopped talking about once Joe Biden got caught 5 separate times with his pants down for the same thing.

Nevertheless, despite Joe Biden committing the same act (likely worse), Special Prosecutor Jack Smith has a reputation of never taking a case he didn’t indict on so that one is likely coming down the pipe as well.

Whether the Fed’s are using NY as a trial balloon or whether they got caught with their pants down and NY jumped in front of them, all of the cases seem to be pure Banana Republic nonsense and reflect what I’ve been preaching for years - we’ve reached the Power Dynamics stage of the political game. Meaning the law is no longer controlling, it’s just who has power and who and how are they willing to use it.

We saw it with the Russian Collusion Hoax, we saw it with the massive and widespread election fraud in 2020, we saw it en masse with the Covid disgrace (I still shake my head in disgust and disbelief that the Government closed the nation for months (except Big Box stores of course), and mandated people wear a dirty cloth rag on their face all day and be mandatorily subjected to an experimental injection that had barely been tested…and that the majority of people not only willingly went along with it, but cheered their own slavery and designation as guinea pigs).

This is obviously a moving target and likely requires its own newsletter, but there are several immediate considerations that jump to mind.

Never in American history has the leading opposition candidate in a 2 party system been arrested and prosecuted by the party in power. That’s pure Banana Republic garbage, especially for a laughably minor ‘crime’ (the NY ‘crime’ was at best a misdemeanor before the DA upped it to a felony).

Mind you, this is the same city that’s has implemented ‘no bail’ and ‘no prosecution’ for almost every crime except murder. And what do you expect would be the “unintended” consequences of such a policy? You guessed it. Rampant crime and lawlessness, people afraid to take the subway and general fearlessness from the criminal element since they know they can rape or assault someone and be out the next morning and likely never prosecuted down the line. Unless they’re a former US President that is. Then you can’t pay a non-disclosure settlement (aka ‘hush money’) to a former lover. Interestingly enough, I’m old enough to remember when President Bill Clinton paid Paula Jones $850K to settle a ‘rape claim’ and no one in the media or the DA even blinked (also See Weinstein and Epstein, et al).

It also brings back memories of Hillary Clinton hiding her payments to create the Steele Dossier (the same Dossier that was the basis for 4 years of law enforcement and media harassment and the evidentiary basis for the Russia Collusion hoax). She categorized those payments as ‘legal fees’ and could be prosecuted under the same legal theory they are using for Stormy Daniels case (a case meanwhile she denies ever happened)

It’s good to be a Democrat.

Bottom line, there are a lot of swirling currents and this is throwing gasoline on the fire for sure. Don’t be surprised if it leads to a constitutional crisis and/or helps accelerate the run on the banks. Again, confidence is paramount. And if you still have any confidence in this Regime, you’re delusional.

If Trump and his people weren’t so damn incompetent and such douchebags to DeSantis, I wonder if Ron would give him cover in Florida and tell NY law enforcement seeking an extradition order to, “GFY”. That’s when things would really get interesting…

Or how about running for President while under indictment for 3 separate crimes, or even better, after being convicted? Pandora’s Box is now open, let’s see what crawls out.

Articles I’m Reading…

Decentralization, Recentralization: American Anarchy & Chinese Control by Balaji.

Why should you care about Stanford Law's hissing, vengeful, snot-nosed students

Best of the Twitter Octagon

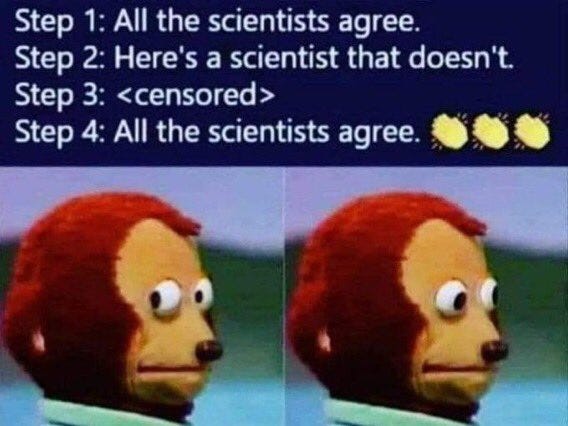

Memetic Warfare

Parting Words

It is a time for strength and courage. As it says in Joshua 1:9

Have not I commanded thee? Be strong and of a good courage; be not afraid, neither be thou dismayed: for the LORD thy God is with thee whithersoever thou goest.

Rak Chazak!

That’s it for now. Buckle up and enjoy the rest of your weekend!

Credit Default swaps are insurance investors can buy against a firm or investment going out of business.

Think of $1 million dollars. At 1000% inflation, that $1 Million now has the buying power of $100K after a year. After two years, it has the buying power of $10K. That’s why inflation is so pernicious.

In traditional finance, 1 call option gives you the right to buy 100 shares of the underlying stock. On many crypto exchanges, 1 Call option is the equivalent to 1 BTC, so 1000 Call options at a $25 strike price would enable you to buy 1000 BTC at $25.

Dank memes comrade