Liberation Day and the Fight for America’s Future

April 2nd, 2025, was declared Liberation Day by President Donald Trump—a bold proclamation that we were breaking free from the post-World War II global order. On that day, Trump announced sweeping tariffs aimed at resetting America’s economic relationships, a move Victor Davis Hanson described as an inauguration of a “Golden Age of trade parity, greater investment in the United States, and higher-paying jobs for Americans.”

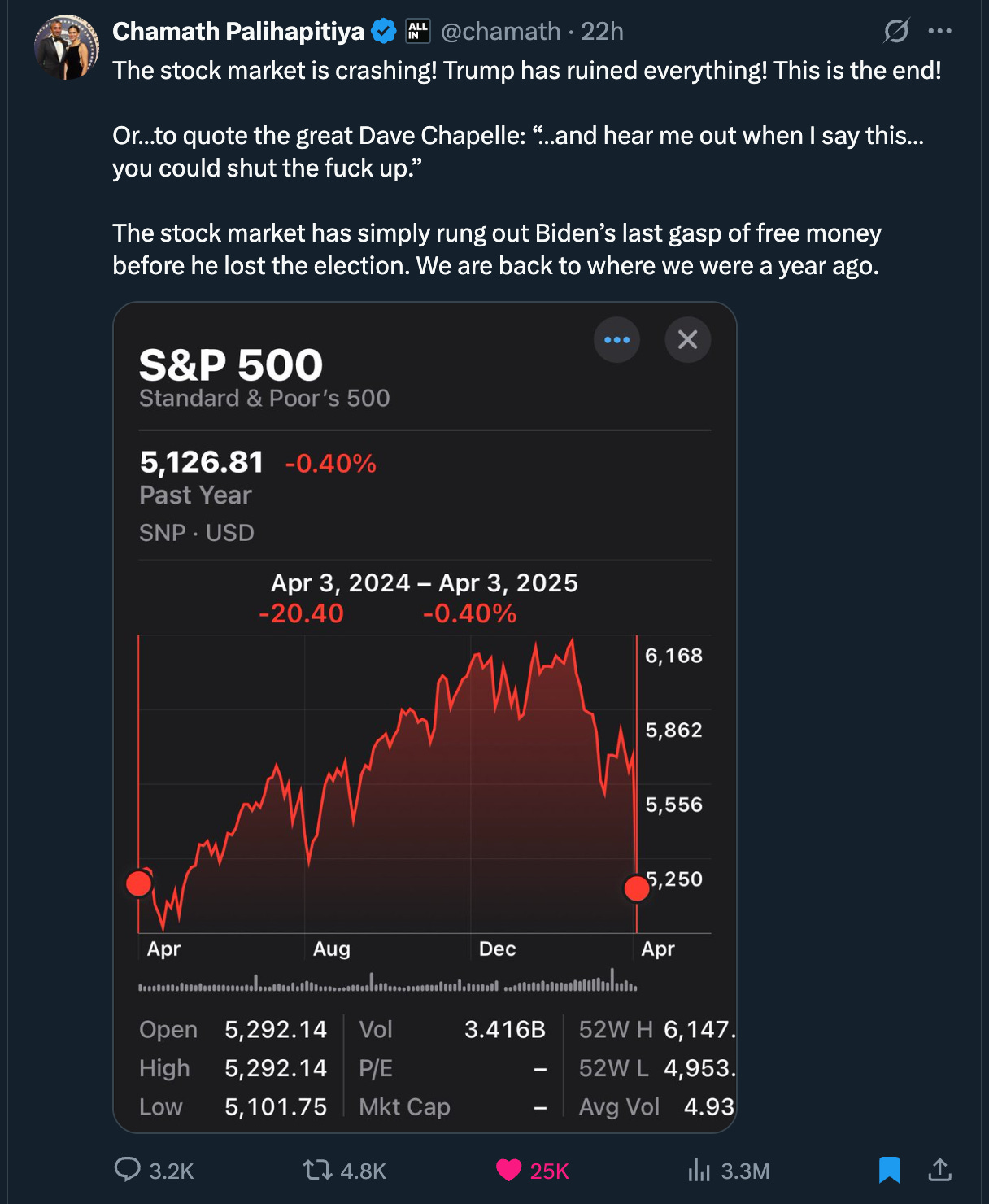

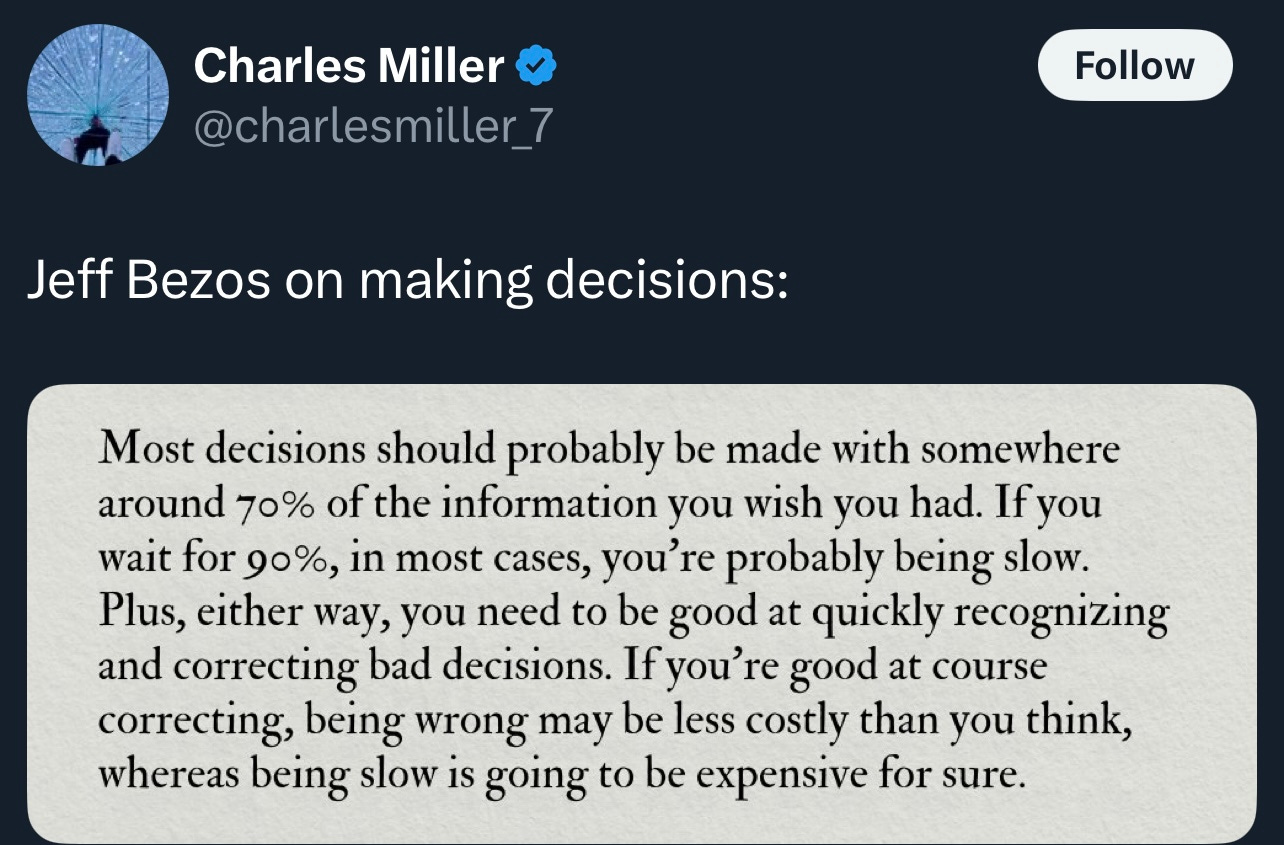

The world, however, erupted in anger. Allies like Canada, adversaries like China, and even domestic voices from Wall Street to the left decried the move. The S&P 500, already down from its 2025 peak of 6150, tumbled to 5075 as markets grappled with the uncertainty. Howard Marks’ words below ring true:

Marks’ quote above is very on point - for both sides. Naturally, I give very little credence to the people who have been wrong about everything over the past 10 years (MSM and libs).

But even for MAGA/Repubs etc, it is 'fog of war', and the outcome is by no means visible or guaranteed.

This is a somber moment. Trump’s tariff strategy is the most courageous and forward-thinking economic policy I’ve witnessed in my lifetime—a radical gambit to save a nation on a direct trajectory towards financial and cultural collapse.

But it’s also a high-stakes bet with no guaranteed outcome. The path we were on—$37 trillion in debt, $2-3 trillion annual deficits, and record income inequality—was a guaranteed disaster. Trump’s plan may not work, but doing nothing was no longer an option. Let’s unpack this extraordinary move, its rationale, its risks, and why, despite the fog of war, it might just be the last chance to preserve the American Dream.

The Roots of Liberation Day: A Nation on the Brink

For decades, the U.S. has been on a collision course with financial ruin.

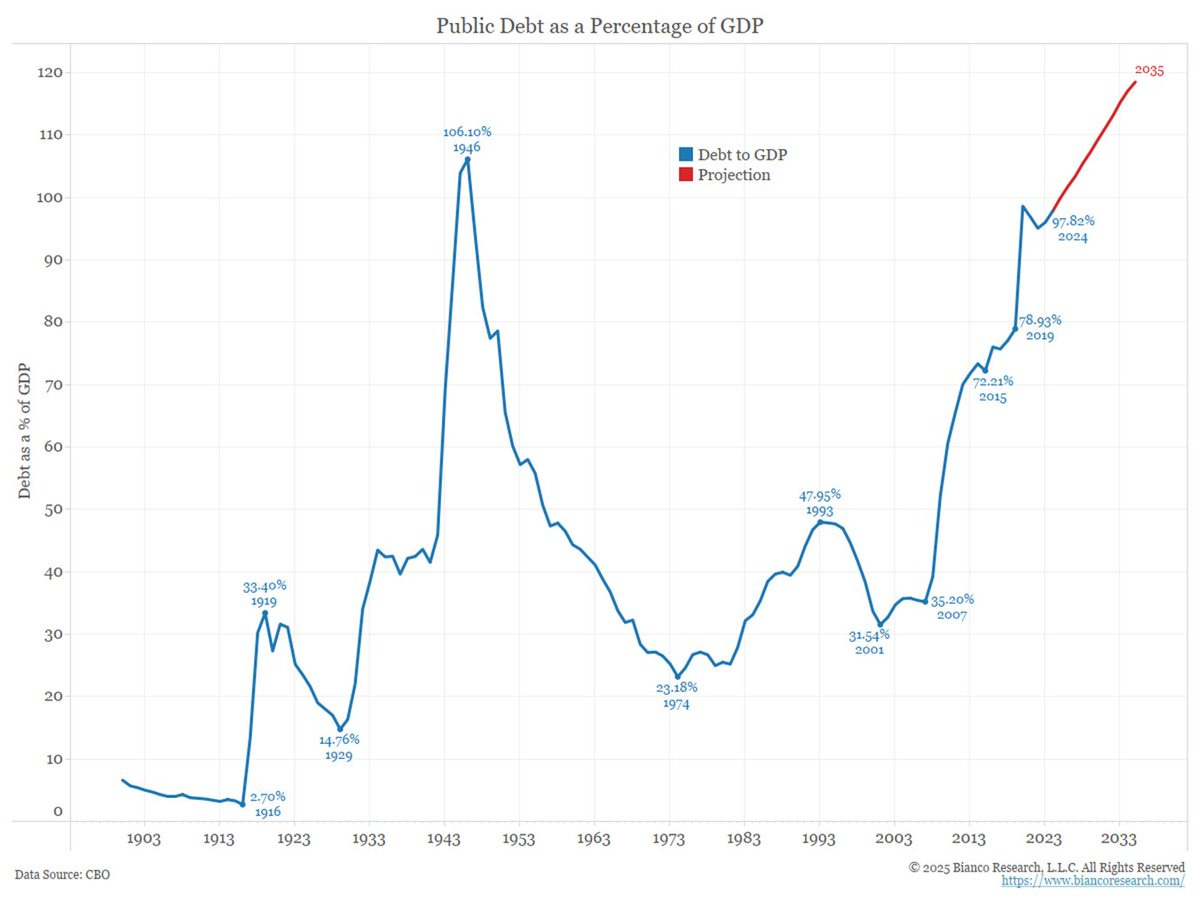

The Congressional Budget Office chart above tells the story: public debt as a percentage of GDP has soared from 35.20% in 2001 to 97.82% in 2024, with projections reaching 120% by 2035. Interest payments on this debt are set to surpass $1 trillion annually, rivaling military spending and crowding out investments in infrastructure, education, and social programs.

Meanwhile, $10 trillion in debt comes due this year, needing to be refinanced at rates that could save—or sink—trillions.

This debt crisis is compounded by a deeper socio-economic rot. As Scott Bessent noted, “The top 10% of Americans own 88% of equities… The bottom 50% has debt—credit card bills, auto loans, and rent.”

Last summer, Americans took record European vacations while more turned to food banks than ever before. Working families, unable to afford a $100 grocery basket, are “topping up” at food banks—a loss of dignity that signals a fractured America.

Housing has never been more unaffordable, pricing entire generations out of the market. The bottom 90% have been treading water or drowning for 40 years, while the top 1%—and the next 9% who serve them in banking, law, and consulting—have seen their wealth multiply.

The American Dream and upward mobility, the promise that anyone can make it through grit and hard work, is fading.

The current trajectory—nearly $3 trillion in annual deficits, a deliberate immigrant influx of 20 million, and cultural destruction—likely meant the end of the country within a decade. Collapse and revolution loomed, with no fix possible once the tipping point was reached.

The Tariff Strategy: A Radical Reset

Trump’s tariffs are not a surprise. He’s been talking about “free and fair trade” for 40 years—since his 1980s Oprah interviews—and made it a cornerstone of his first term and 2024 campaign, trailing only immigration, inflation, crime, and cultural issues like men in women’s sports.

But the scale and speed of Liberation Day caught the world off guard. These aren’t just reciprocal tariffs, as Victor Davis Hanson suggested, mirroring what other nations impose on us. Trump’s tariffs are set at levels substantially above—often multiples of—counterparty tariffs, a “shock and awe” negotiating tactic called setting an extreme anchor straight from The Art of the Deal. Ask for the moon, settle in the middle.

The strategy has multiple aims:

Reshoring and Economic Revival: By making imports costlier, tariffs incentivize corporations to bring manufacturing back to the U.S., rejuvenating Main Street and boosting wages for the working class. This addresses the hollowing out of America’s industrial base—70% of our towns are ghost towns, littered with shuttered factories and opioid-addicted populations.

National Security: The COVID-19 pandemic exposed our reliance on foreign supply chains for critical goods like PPE and pharmaceuticals. Worse, we depend on China—our primary geopolitical rival—for military components. Tariffs aim to reshore these industries, ensuring the U.S. can produce what it needs in the Western Hemisphere. Canada and Mexico were largely exempt for this reason, though Trump’s clumsy handling of Canada risks undermining a potential Western Hemisphere economic bloc.

Closing the Deficit: Tariffs generated $80 billion in 2023; higher rates could yield more. Additionally, the uncertainty around the move has [intentionally] driven the 10 year yield to below 4% helping to refinance $10 trillion in debt at lower rates and saving trillions in interest. This revenue could fund tax cuts for the middle class, raise the no-tax income threshold to $100,000, or reduce the deficit—though, as I’ve long argued, this is 95% a spending problem, not a revenue one. Revenues are up huge since Bush and Obama - but spending has grown even faster. Enter DOGE (Department of Government Efficiency), tasked with slashing waste.

Leveling the Playing Field: For 50 years, the U.S. has run trade deficits—$1 trillion in 2024 alone—while other nations impose high tariffs on our goods. China, India, Vietnam, and the EU have thrived with prohibitive tariffs, yet they decry Trump’s response. As Hanson asked, “If tariffs are so destructive, why is China booming? How did India become an economic powerhouse?” The hypocrisy is stark: Canada, with a $63 billion trade surplus, imposes tariffs up to 250% on U.S. products, yet cries foul when we reciprocate.

Rebalancing Global Burdens: For too long, the U.S. has shouldered the cost of defending the “free” world—$1 trillion annually for military and shipping lanes—while allies free-ride and criticize us. Trump’s tariffs and tough talk to Europe around NATO defense spending signal that this era is over. As he put it, “Drop your tariffs, or we’ll keep ours. It’s your choice.”

The overarching goal here is simple: to create a level playing field for trade.

What’s missing from the conversation—especially in the mainstream media, and from those who still inexplicably trust the nightly parade of talking heads—is the basic admission that none of these tariffs are coming out of the blue.

The reality is, nearly every major country already slaps high tariffs on American goods while demanding free, unrestricted access to the largest and wealthiest consumer market on earth.

It’s a one-way street—and it has been for decades.

Someone explain it to me:

Why should other countries be allowed to impose steep tariffs on American products while expecting zero in return?

If you’ve got a good argument, feel free to drop it in the comments—because I haven’t heard one yet.

The Market’s Reaction: Fear of the Unknown

Markets initially rose over 1% when Trump spoke of “reciprocal tariffs” in his Rose Garden speech, signaling support for leveling the playing field. But when he revealed the actual tariff levels—far exceeding those of trading partners—the S&P 500 plunged.

Why? Capitalism is a confidence game, and uncertainty is its enemy. Press reports indicate that “all deals are now on hold” as businesses pause amid the fog of war. Highly leveraged fast-money shops have been forced to liquidate, compounding the decline. Stocks of even the best companies now trade at valuations more in line with market averages as opposed to the insanely stretched multiples we saw over the past 12 months.

The market’s fear isn’t opposition to reshoring or fair trade—it’s the risk that Trump’s strategy fails, leading to a prolonged trade war or recession. If tariffs remain high, consumer prices could rise 1-2%, hitting the bottom 90% hardest and exacerbating inequality. Retaliation from China or the EU could cost exporters billions, as we saw in Trump’s first term with soybeans. And automation, not trade, is the real driver of manufacturing’s decline—tariffs may not create the jobs we hope for.

Yet there’s good news: several countries have already approached the negotiating table, suggesting Trump’s Gambit is working. As more nations come to terms, those holding out will fear being left behind, potentially triggering a tipping point where markets and trade soar for those that play ball and agree to level the playing field.

A Courageous Bet—But at What Cost?

Trump’s tariffs are the first long-term strategic thinking I’ve seen from a president in my lifetime. Every other leader, with the partial exception of Reagan/Volcker, has lived quarter to quarter, promising short-term goodies to win elections while avoiding tough decisions. This cowardice left us with $37 trillion in debt, a Balkanized society, and a cultural landscape on the verge of collapse.

Trump could have kicked the can down the road—juiced the stock market, deported the 20 million illegal immigrants, and secured a spot on Mount Rushmore. Instead, he chose the harder path: a reset to give America another 70 years.

This is a bet on mutually assured destruction—except it’s not mutual. The U.S. is playing Russian roulette with one bullet in the chamber; our trading partners have five. We can keep spinning as long as they want, but they’ll lose first. The goal is to force a new global economic order, what Scott Bessent called “a grand global economic reordering, something on the equivalent of a new Bretton Woods.”

The status quo—foreign nations endlessly funding our debt and deficits—is untenable. If you don’t like this radical policy, propose another. Returning to the path of ever-rising debt is not an option.

But the timing worries me. This voluntary, early term move—while strategic and necessary—consumes immense political capital. It makes it harder to pass critical measures like remigration, election security and voter ID, which should have come first to harden our democratic defenses. The pain of swallowing this economic “elephant” may last 6-18 months, ideally before the midterms, but it risks overshadowing other priorities.

And with AI poised to disrupt labor markets within the next three to five years, the window for tariffs to make a meaningful difference is already beginning to close.

The ugly truth is this move should have been made a decade ago—or even earlier.

But our politicians and so-called advisors were too busy selling out the American middle class and lining their own pockets, enriching themselves and their friends while the foundations of our economy were being hollowed out.

The Stakes: A Last Chance for the American Dream

Trump’s plan is not without flaws, but it’s the only chance the bottom 80% have. For 40 years, our elites have sold out the American worker, leaving ghost towns and despair in their wake.

The security state used a virus—one they helped create—to shatter the world economy and the social contract into a 1000 pieces, while 20 million illegal immigrants were resettled to create a permanent Democratic majority. Income inequality blew out under Biden as home prices and equities doubled, yet the media’s criticism of inequality, so deafeningly loud during Trump’s first term, went silent.

The tariffs aim to give others besides the top 1% a shot at prosperity, and they’re part of a broader vision: enforce immigration laws, induce self-deportation of illegal immigrants by targeting employers and landlords, break inflation’s back (already working as egg prices and gas hit their lowest levels in years), and rebalance global security burdens.

If successful, they could lower interest rates, saving trillions, and fund tax cuts for the middle class while perhaps even eliminating loopholes for top earners like carried interest or offshore tax havens for tech giants like Apple and Facebook.

But there’s no guarantee this works. The path we were on was leading to disaster—$50 trillion in debt by 2030, the dollar’s destruction, and social strife that could end the country. As Hemingway wrote, “How did you go bankrupt? Gradually, then suddenly.”

Well we’ve been going bankrupt gradually for 25 years. Trump’s Gambit aims to stop us from entering the “suddenly” phase. If it fails, we could face mass depression, financial collapse, and possibly the end of the nation by 2040. If it succeeds, we buy another 70 years to navigate challenges like AI dislocation.

Waiting in the Fog of War

Trump cares deeply about the economy and the stock market, viewing them as key measures of his success. He has consistently shown a willingness to pivot when strategies falter, and early signs—countries stepping up to negotiate—suggest his approach may already be bearing fruit.

That, ultimately, is the real key. Like so many of Trump’s past moves, everything is a negotiation. And say what you will about him—the man is a seasoned, battle-tested dealmaker. I’m hopeful that what we’re seeing now is a textbook example of “setting an extreme anchor.”

Anchoring bias is a cognitive bias where people place too much weight on the first piece of information (the “anchor”) they encounter when making decisions—even if that anchor is extreme, absurd, or completely unrealistic.

When someone makes an outrageous opening offer, they are setting the anchor.

Even when the other side recognizes the offer as extreme, their counterproposal—and ultimately the final agreement—is still unconsciously pulled toward that initial number.

The result: Negotiations end far closer to the outrageous opening than they otherwise would have.

If Trump is applying this deliberately—and it certainly appears that way—then markets should stabilize as progress is made on individual tariff deals, which already seems to be happening. As uncertainty declines, confidence returns.

If most countries agree to limited or no tariffs—or, at worst, to reciprocal tariffs—this could ultimately be a tremendous success.

And as I’ve said before, I’m not particularly inclined to listen to the critics. These are, after all, the same people who have been spectacularly wrong about just about everything over the past decade—from COVID to immigration and beyond.

A stable hand on the trading wheel is a patriotic one: the more we support his strategy, the higher the chance it succeeds. And take with a grain of salt the loud condemnation of critics. Just as we sadly saw during Covid, most of these TDS riddled subversives would rather see our country fail than Trump succeed.

But as Howard Marks warned, no one knows what the future holds. Be wary of those who claim to know what will happen. This is a fog of war socio-economic battlefield, even for Trump’s supporters. The disruption is real, the stakes are existential, and the outcome is uncertain. Liberation Day may go down as the boldest move of our lifetime—or the one that dooms Trump’s presidency in a society unaccustomed to sacrifice. We’ll have to wait and see how it plays out. In the meantime, let’s hope this courageous bet gives the American Dream a fighting chance.

For more on the above, listen to the Scott Bessent interview below.

Weekend Notes: Markets, Mayhem, and Opportunity

There’s been a lot of noise on X this weekend about “Black Monday” and ominous crash charts making the rounds.

Personally, I don’t think we get a full-scale meltdown—but if we do, I’d view it as a gift-wrapped buying opportunity.

Back when I was on the trading desk, major external shocks tended to follow a familiar pattern:

Day 1: Heavy selling.

Day 2: More panic selling.

Day 3: Gap down at the open... which almost always turned out to be a buy.

Let’s see if the old “buy the Day 3 gap down open” maxim holds true on Monday.

Typically, it takes about three days to wash out the weak hands. You can also expect margin calls to start hitting after two brutal days—those who can't meet them will be forced to sell, creating more forced deleveraging.

My guess? If the S&P 500 puts in a "4-handle" (something starting with 4,000), it probably gets bought for at least a short-term counter-rally. But I’m not sticking my neck out too far. There's still a lot of dislocation under the surface, and we need to see how the dust settles.

Frankly, the move from 4700 to 6100 felt ‘fake’ to me the entire time.

Now we know why: it was a sugar high, fueled mostly by Biden’s government giveaways and mass immigration handouts, and then a surge of Trump-fueled business optimism.

If this is a true rewrite of the post-war economic order, we should expect some rough seas ahead in the short-term.

Individual Names I’m Watching

• TSLA1:

Tesla found support in the past around $220. I'd almost prefer to see that break, because the next real support sits at $170—where I’d get much more aggressive as a buyer.

Yes, I think it’ll be a rough year for Tesla politically. Musk is drawing fire from every direction. But let's stay long-term focused:

FSD (Full Self-Driving)

Optimus (humanoid robots)

Each of those alone could be a trillion-dollar business.

Buying the whole car company plus two potential trillion-dollar businesses for $500B?

Seems cheap.

• CEG (Constellation Energy):

Finally hit my $165 target.

This is the best nuclear power fleet in America. It just got cut in half—dropping from a 52-week high of $350 to $165 in about two months.

Much more attractive here, especially if you think AI data compute energy needs will continue to grow.

Two Special Situations if You Want Bitcoin Equity Exposure

• Gryphon Mining (GRYP):

Let’s be clear—this isn’t a good Bitcoin mining company. In fact, it’s terrible. But the price has gotten so cheap it’s interesting.

They’re now pivoting: redeploying their mining rigs for AI compute and other ventures.

If you’re curious, read the latest conference call here.

• Bitcoin Depot (BTM):

8000 Bitcoin ATMs.

Trading at around 2x EBITDA—compare that to Nasdaq companies trading at 20x.

Market cap is just $25M. Dirt cheap.

In Friday’s carnage, Bitcoin barely budged, a strong countersignal (my guess is market dislocation and potential recession fears may necessitate Jay Powell cutting rates or injecting liquidity - both historically good for Bitcoin). Equity exposure like BTM could be interesting if Bitcoin stays strong.

Final Thought

Those in my small private coaching group knew this down-move was coming.

Every week in Alpha360 we talk about markets, money, investing, and geopolitics—and more importantly, how to navigate it all like a pro.

If you're serious about becoming a better investor and learning how to move intelligently through the financial and political storms ahead, reach out.

You can join us—or sit in for a free session and see if it’s the right fit.

Your future self might thank you.

What I’m Watching and Reading…..

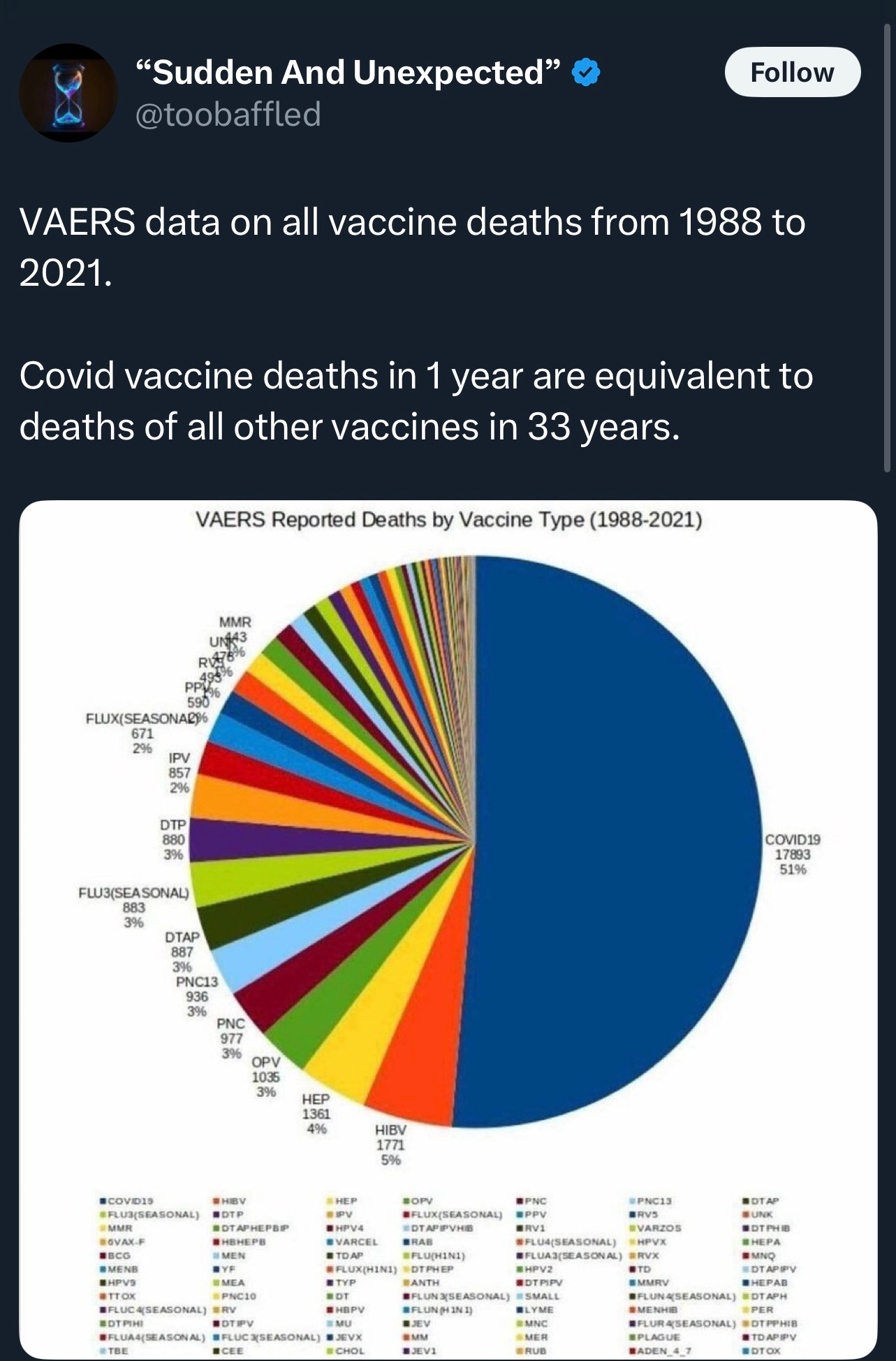

Scott Bessent on Tucker Carlson. Bessent is the most important economic voice in the world today and one of the architects of the tariff strategy. Better to hear the ‘why’ from him than an AWFL (affluent white female liberal) talking head on ABC Nightly News.

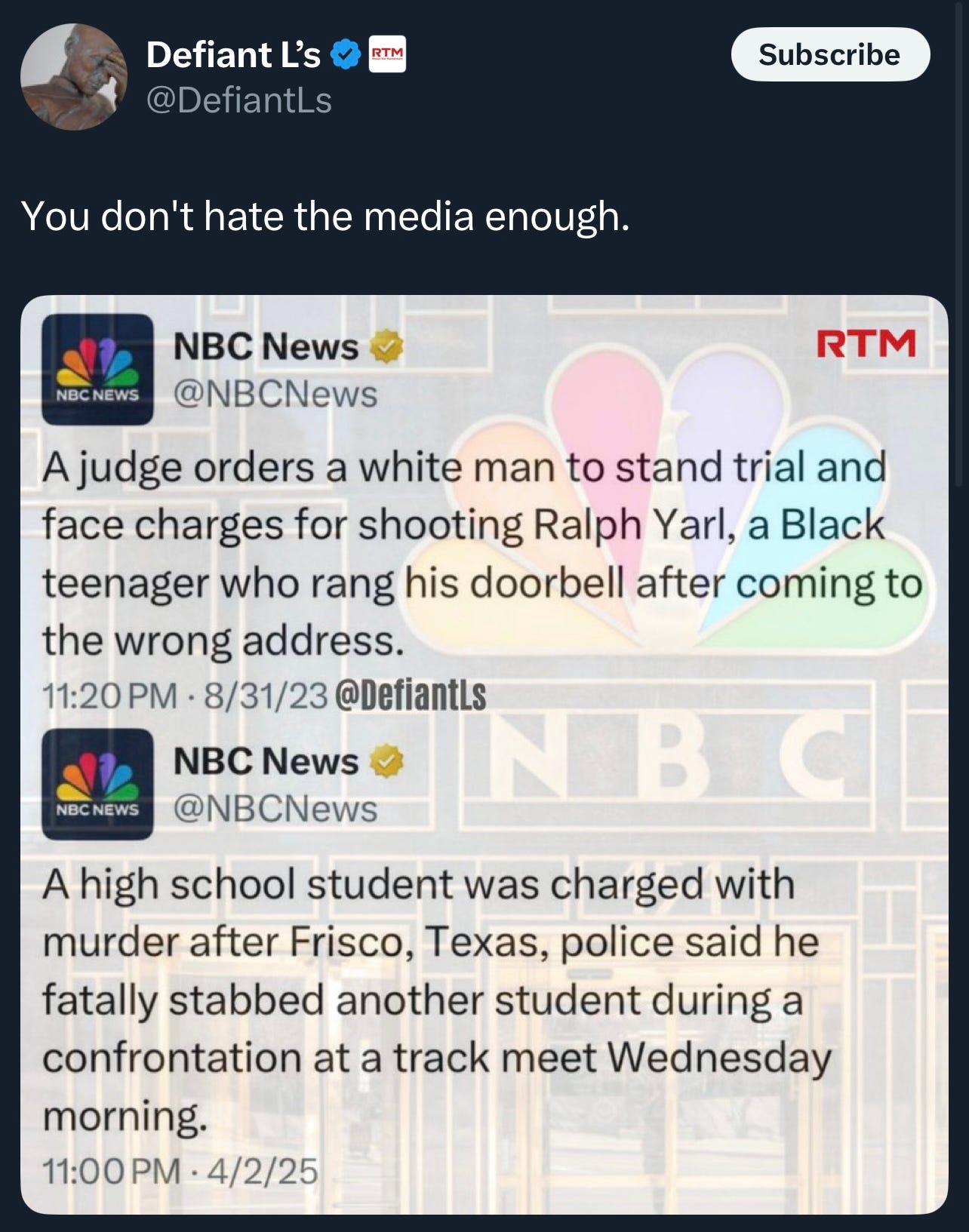

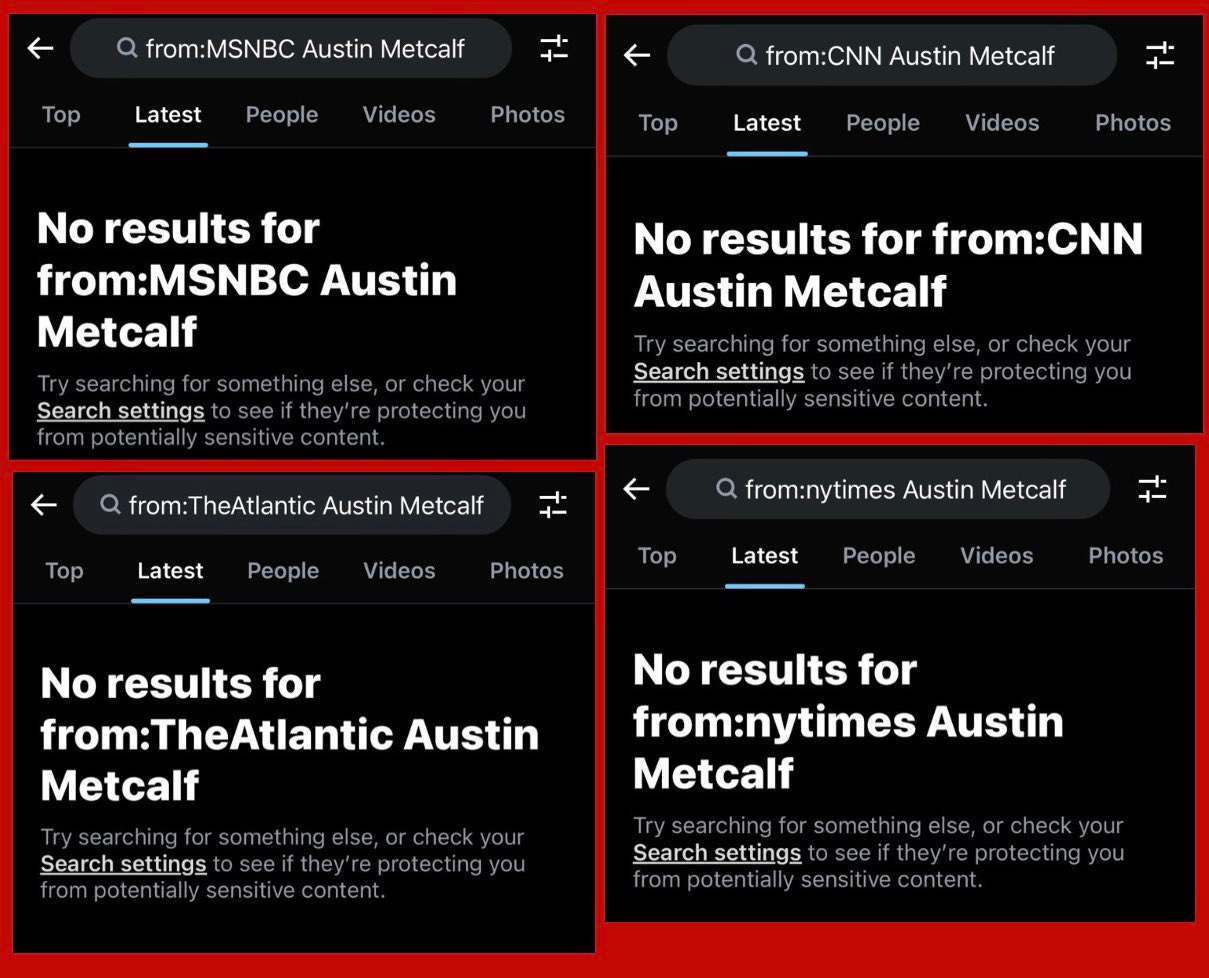

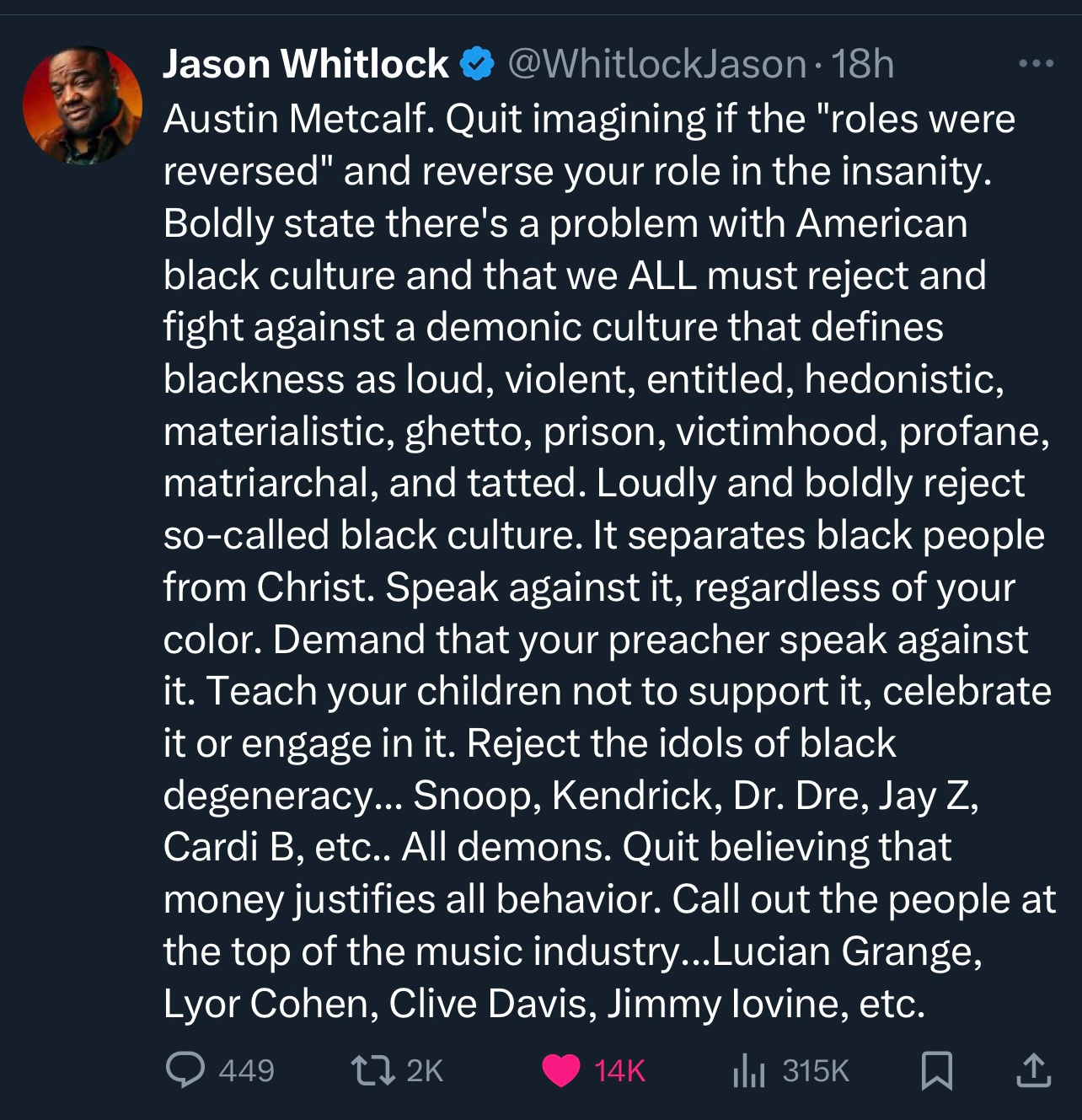

Best of Twitter

Memetic Warfare….

Parting Words….

That’t it for this week folks! Hope you enjoyed. If you did, please share it with a friend or consider becoming a subscriber. -MK

Note: My family or I own or are considering owning all of the above. This is not financial advice. There will be no updates here if I buy or sell.

Once upon a time, I looked forward to my Sunday newspaper. Now I look forward to your email. So much great info here that people should be aware but will likely never be as MSM will never report anything that might help Trump. The tariffs are a huge gamble and as you've pointed out may have been better done after other priorities were accomplished. And for those of us in the lower or fixed income brackets, it's damn scary in the moment. Hoping the extreme anchor works! Thanks again for the great info

The first fair and balanced commentary I've seen on the tariffs. I fear you may have put your finger on it with this though "Liberation Day may go down as the boldest move of our lifetime—or the one that dooms Trump’s presidency in a society unaccustomed to sacrifice." Thanks again for your weekly articles, I always look forward to them.