Welcome back to Week Two of Sovereign Sunday!

As the GOAT prepares to go to battle with Patrick Mahomes and the reigning Champion Chiefs, here's a reminder that it's still a disgrace that the Monday after Super Bowl isn't a national holiday.

Which reminds me of the much vaunted Super Bowl Indicator that was all the rage back in the 80s and 90s on trading desks. The premise was simple - a Super Bowl win by an AFC team prophesized a bear market in the upcoming year. Conversely, a win by an NFC team is bullish and means the stock market will rise in the coming year.

At one point in time, the Super Bowl Indicator boasted a more than 90% success rate in predicting S&P 500 price action in the following year. However, Federal Reserve quantitative easing (printing), and a massive bull market over the last few years combined with an AFC hot streak means the Indicator has been wrong every year since 2015. So much for random football-stock market predictions and a reminder of one of the more important maxims out there, correlation does not equal causation.

Speaking of Markets, Indicators are Flashing Yellow...

A series of technical, psychological and fundamental indicators I follow aren't looking all that great after this massive move. The big caveat - it's really, really, really hard to time markets. 95% of traders lose money over the long run.

Having said that, there are times where the risk reward is either in your favor or against you. I spent the last 3 years telling anyone who would listen that bitcoin between $3-6K was quite possibly the best risk/reward trade I'd ever seen with massive asymmetric upside. A combination of an exponential technology with a positive feedback loop incentive mechanism and true digital scarcity made its ascension a relative no brainer as more people came to understand it (to this day, the one corollary I still see is that the biggest bears on bitcoin, are those who understand it the least). Risk/reward was in our favor back then.

When it comes to stock markets however, it’s a lot more complex. The markets can be wildly overvalued by traditional metrics, but they can stay that way a lot longer than you'd imagine. Most importantly, as long as we own the magical printing press (brrrr), we can and will print dollars which will flow into speculative assets due to perceived safety and lack of other options (what, you would rather buy 30yr European bonds at negative interest rates? A negative interest rate is an aberration that should never exist in a remotely health monetary system. It basically means you have to pay money for the right to invest and will get back less than you put in 🤔).

Before Bitcoin came into existence, stocks and real estate were thought to be attractive, or at a minimum, the least worst option amongst a lot of really bad options in a high inflation environment. There’s also the radical notion that Central Banks can and will actually buy equities to 'help the economy', as the Japanese and Swiss have done. Japanese central banks are now the largest owners of public equities in their country.

One thing any professional trader will tell you, is that it's possible to get the timing or the direction of the markets right, but damn near impossible to get both. This isn't financial advice. But if you're jacked long, now might be a good time to at least ease off the gas and raise a little cash.

A Three Prong Approach to the Current Madness

In light of the creeping Marxist Totalitarianism, 3 options keep popping up in guarded conversation among realistic peers around what to do with the hellscape we find ourselves in:

A. Fight Like Hell - Properly assess the threat vectors to you and your family's financial and personal security, and then advocate forcefully for traditional American principles. Obviously, Woke Totalitarianism doesn't beggar differences of opinion. In the marketplace of ideas, it fails miserably on every level - pragmatically, morally and spiritually. Therefore, it has to utilize censorship and violence or the threat of violence to enforce compliance.

B. Soft Exit - Move to states/cities/towns with a healthier 'climate', and opt out of the cartels where possible. Starve the economic beast and employ other 4G principles in an economic and cultural war of attrition.

C. Sayonara - Exit Entirely. Attempt to live your life somewhere not polluted by the ugly authoritarians sweeping the nation, and wage a proxy campaign from abroad, or just live our your remaining days hopefully in peace.

D. All of the above.

Either way, it is a deeply unique and personal choice. My friend Jeff Gisea has a great article below that captures the conversations many in my circles have been having for the last few years. The timing and urgency has picked up steam dramatically with the return of the Establishment Cartels/Bolsheviks to unilateral power.

Articles I’m Reading…

Should I Stay or Should I Go? Thoughts about the Age of Exit

WHO advisor: COVID-19 pandemic likely started via lab leak

I received a lot of hate mail and was called a kooky 'conspiracy theorist' when I speculated last February that the Covid virus started in a Wuhan lab. The evidence continues to show that was likely what happened.

Amazon's Leadership Principles

We can actively oppose what they stand for (I'm helping a phenomenal startup right now build and challenge their hegemonic dominance) while still learning from what made them a success. As Sun Tzu said, “If you know the enemy and know yourself, you need not fear the result of a hundred battles. If you know yourself but not the enemy, for every victory gained you will also suffer a defeat. If you know neither the enemy nor yourself, you will succumb in every battle.”

The Gaming Superstar’s Message for Parents

Parker Lewis on why Bitcoin Obsoletes All Other Money

Deep Learning will Create $30T of Value over the Next 15-20 years

The difference between amateurs and professionals - underrated tweetstorm by Shane Parrish !

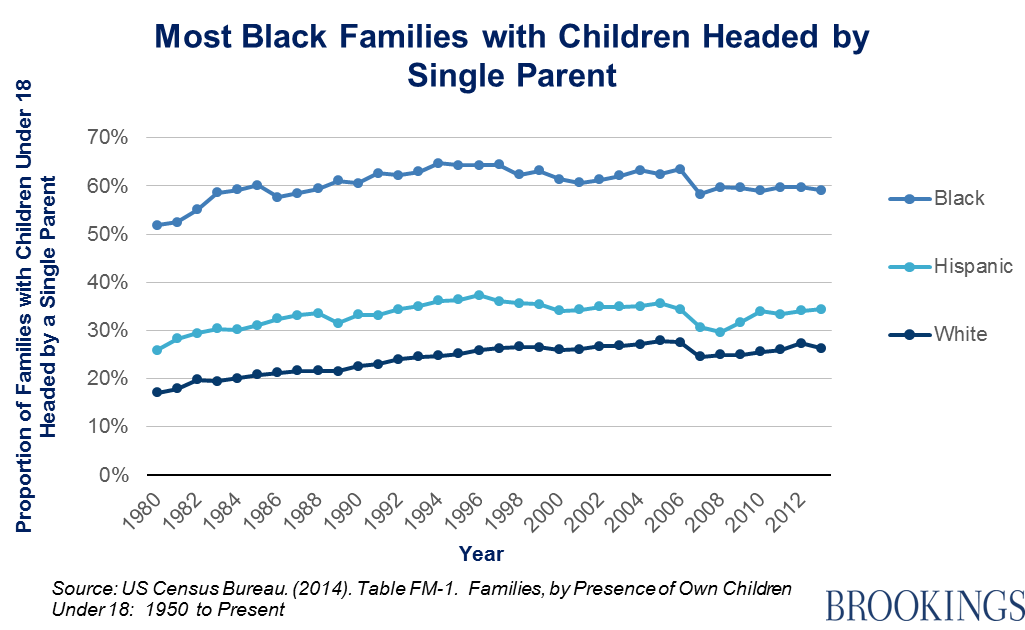

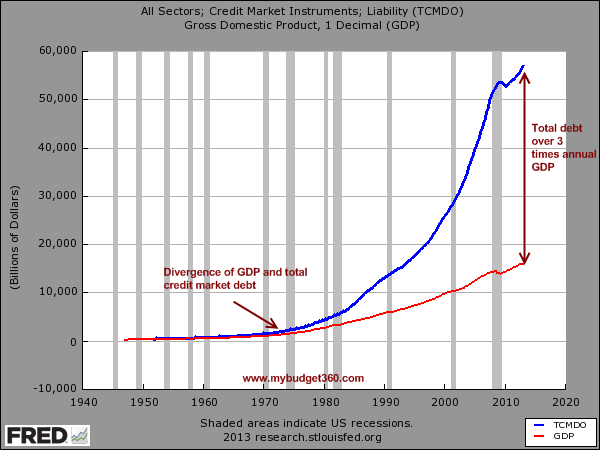

The 2 Most Important Charts Out There: Fatherlessness and Total Debt/GDP

Until we properly diagnose and address causes and solutions (ahem, Drug War), expect more societal disintegration and chaos.

What I'm Working On.... (and curious about)

Psychedelics will Revolutionize Treatment Resistant Depression

Also, how do we marginalize and defang Amazon, Facebook, Apple and Google through decentralized technology and #BetOnMainStreet? More of this to come.

What I'm Listening to....

Disruptive Innovation with Ark's Cathie Wood

What I'm Watching...

Saifedean Ammous' Salt Talk

Chamath on CNBC talking GameStop and RobinHood

What I'm Reading and Re-Reading

Art of Impossible - Steven Kotler continues his Collective Flow Project.

John Maxwell 3 Things Successful People Do - a concise and valuable blueprint. Success is:

1. Knowing your purpose in life

2. Growing to reach your maximum potential;

3. Sowing seeds that benefit others

4th Generation Warfare Handbook - William Lind's classic a framework for understanding postmodern conflicts. The book is only 100 pages and can be read in a few hours. This article gives a good summary. Note how 4GW principles that originally described Al Qaeda and insurgent Iraqi groups have been used over the past few years by identitarian groups, homegrown dissidents and resistors, etc.

Twitter Octagon

Parting Quote

It's broken people that lead broken people to breakthrough.

The single biggest thing you can do today to back Sovereign Sunday is to subscribe to the newsletter. It’s free and easy to do. If you’ve already signed up, please share this with your friends. And thank you, I’m grateful for your support.

If you missed the first issue, it was jammed with pertinent, carefully curated information. Here it is again. And don’t forget to punch the subscribe button.