Is it me or is March Madness losing it’s brandable distinction? After all, we’ve been in a state of perma-madness for over 2+ years now. We watched mass house arrest, capricious property confiscation and the government destroy our economy and future over a treatable cold. We saw men come to dominate women's sports, and a laptop filled with evidence of corruption and child porn belonging to the son of a Presidential candidate be dismissed and censored as 'Russian disinfo' despite everyone knowing that was a bald faced lie and cover up. And so, labeling a tournament month where a 15 seed can upset a 2 seed as ‘Madness’, doesn’t really quite have the kick it once had does it?

Ukraine Predictions

Early last week I predicted, “We're likely 2 weeks or less to a negotiated solution.” That makes next week the conclusion of this maddening, fully avoidable conflict. If hostilities don’t cease this week and continue for another month or longer, very little of what I say below will matter or be accurate.

Why did I think we were 2 weeks or less away from a ceasefire negotiated solution? Well partially because I’m an analyst with decades of experience who expertly utilizes the two analytical superpowers - probabilistic thinking and pattern recognition. That’s the proper answer.

The real answer is I made that prediction because I suffer from ‘Normalcy Bias’.

We all do.

However, I’m slightly better than most at course correcting for my implicit biases because I am aware of said biases, and can counter them. In fact, we’ve spent numerous sessions at Alpha360 doing specific trainings on identifying and countering biases, especially on the behavioral finance front.

Implicit bias refers to attitudes, prejudices, and judgments that we unconsciously hold. They’re ingrained in our subconscious through our individual experiences, upbringings, and backgrounds.

Implicit bias, unchecked and unnamed, can have harmful, debilitating, and long-lasting effects in our quest to accurately assess information and make proper choices based on that information.

Normalcy bias says we haven’t felt the kind of pain that is coming in most of our lifetimes. Therefore, it’s unlikely to happen and ‘something’ will happen to fix, repair or stem the forthcoming seismic shock.

The bottom line is if we don’t get a ‘solution’ within 2 weeks to the Ukraine conflict, the knock on and cascading effects will be too cataclysmic. The best case scenario is already $5 gas, some food shortages and inflation continuing to spike higher. A prolonged conflict and increased escalation opens up all types of economic hell including a few semi-serious kinetic ones like nuclear annihilation.

I don't think this will happen, but it's clearly the closest we've been on the Doomsday Clock since the Cuban Missile Crisis. And back then we enjoyed Mutually Assured Destruction, adults in charge and a closed, heavily filtered media. (For an interesting example of the idiocy of such subjective metrics like the Doomsday Clock see this article. Under Trump, he was so mean and dangerous that the clock was moved 3 times closer to midnight indicating increased chances of societal annihilation and extinction. In the last month with 2 nuclear powers coming closer and closer to open kinetic warfare, the clock has not moved. Much like Politifact and the ‘Fact-Check’ fraudsters, the outcome/verdict is dictated less by objective metrics, and more whether it’s an official DNC approved Talking Point.

Cuba 1962 is a mighty big difference from today's world where the emotionally driven Karen AI HiveMind can be easily triggered and take on a destructive life of its own. Check my friend Jack Murphy's twitter thread to see what I'm talking about. Emergent networks have been one of the areas I've focused my attention for the past few years. Whether it is tech driven math money networks like bitcoin or social networks governed by DAOs, networks are replacing our legacy institutions across the board. It would be wise to study up and understand the implications. But that's a note for another day.

Reinstate the Draft.

While by no means a geopolitical expert, I know human nature and and have a bit of common sense. To end this tragic conflict, Ukraine and Russia will both have to make painful concessions (spare me the childlike whining ‘But Ukraine didn’t do anything wrong! Why should they pay!…). All sides (including the US) bear responsibility here.

A good, lasting deal will typically requires both sides to walk away feeling like they left something on the table.

In this case, the most obvious outcome seems to be for Ukraine to give up or guarantee the security of the Donbas region/Breakaway Republics in exchange for security guarantees of their own from Russia regarding the territorial integrity of the remainder of Ukraine. End of story.

Further arming Ukraine or talking about admittance to NATO or further escalation just increases the scale of the humanitarian disaster, which is already monstrous.

The Blue Checkmark useful idiots in the U.S. continue to be very loud and brave with other people’s blood and treasure from afar.

Stand with Ukraine?

You couldn't even stand with your own family, friends and neighbors the past two years.

Call me a cynic, but I think we should instantly announce we’re reinstating the draft here at home (with no exemptions) to help fight the impending war some in power and media are cheerleading. The war drums from the chickenhawks will go quiet instantly and there will be a negotiated solution to this manufactured crisis within 48 hours.

The blue checks and jackals are happy to send other people’s children to die in foreign lands. It’s time the political and laptop class had some skin in the game too.

Victory Lap

5 months ago in October I laid out the game plan for the next 6-12 months. Due to rampant inflation, botched Covid policies, political incompetence, Fed policy mistakes and the like, I drew a roadmap that you hopefully followed. Cash, commodities and some crypto. No bonds or equities. Button up and buckle up.

The commodity trade was a monster, and I think we saw the highs last week. A good rule of trading is to sell parabolic spikes and buy ‘bid wanted’ bloody street bottoms. We’ve seen a couple of the later over the last few years (Bitcoin & equities March 2020), but fewer parabolic blow-off tops. Oil $140, Nickel $100K, and most of the other commodity spikes we saw last week will probably be the short term top. It’s still a good trade and up huge from October, but the risk/reward has changed. Take some profits and stay nimble. Short term cash is still king.

To see what I’m thinking and doing now in markets and life, follow me here. Ghost is a censorship resistant platform (Redundancy), and the goal is to focus less on politics and more on markets, sensemaking and sovereignty. You can also see what I’m calling one of my best ideas and sectors this year when I release the 2Q RoadMap this week.

Focus Your Attention Where it Counts

Hierarchies of impact and control look like concentric circles.

If you’re spending a disproportionate amount of time on the outside rings rather than concentrating your focus inside to out, then you’re giving up agency for anxiety. You have limited to no impact on the outcome in Ukraine. You have enormous sway on you and your family’s health, impact and vision.

Psychologist Emma Kenny wrote social media, “Teaches us to externally gaze into worlds that we cannot change and have no impact or power over, instead of internally gazing into our own worlds which we have complete control and power over.

So take a step back, and perform a system check by asking yourself these questions:

Where am I spending my Deepwork time?

Where is my hour to hour focus?

Where can I get a better ROI for my time, treasure and talent?

Adjust accordingly.

Yield Curve Clues

Watch the Yield Curve Inversion. For those unaware, the yield curve is a great predictive mechanism for future economic growth.

The slope of the yield curve tells us how the bond market expects short-term interest rates to move in the future, based on bond traders' expectations about economic activity and inflation.

A normal yield curve has rates lower in the short term and higher for longer durations which makes implicit sense. It’s more risky to borrow money for 10 years than it is for 3 months. The rate should therefore be higher for the 10 year loan.

When the yield curve is "inverted on the short-end," that means short term rates are higher than long term rates. That suggests that the traders are expecting a slowdown in the U.S. economy.

None of the US recessions in the last 70 years have occurred until the 2s/10s (2 year US Treasuries vs 10yr UST) have inverted, and on average it takes 12-18 months from inversion to recession.

However the speed of the supply shock and inflation spike, and the speed of collapse in consumer confidence (it’s often the ‘rate of change’ that matters more than the actual change in markets), means we’ll be be looking at a much faster recession onset than historical precedent.

The levels I’m seeing in the yield curve, consumer sentiment, PPI and CPI (inflation is the highest it’s ever been in our history if you use real stats, forget this “40 year” nonsense) are indicating a recession on the horizon.

I forecast a recession even before the Ukraine conflict based on the Fed's policy mistake of aggressively raising rates. The war makes it a done deal. The only question is how severe. By the third or fourth quarter this year it will be obvious one began this Spring

The Biden administration and mainstream news sources can pretend this was Putin’s fault and that somehow, the stagflation nightmare we’re facing was a surprise, but many of us have been writing about it for over a year.

Six months ago, I gave a very specific prognosis detailing what we were about to face and how to position your portfolio to protect yourself. And that was before Putin’s Gambit (which our own political and public health class is quietly applauding as it took them out of the crosshairs for their crimes against humanity during Covid and repositioned the scope on the world’s favorite boogeyman).

Recessions are different now. In the old days, recessions acted much like brush fires.

There is a natural cycle of destruction and recreation that is facilitated by forest fires. Even devastating forest fires lead to a fairly rapid and robust recovery and rejuvenation of ecosystem health in boreal forests.

Evidence shows that when humans prevent forest fires for extended periods of time, it leads to worse, more devastating fires later from which it's harder for the ecosystem to recover.

When humans try to stop them, they usually end up causing more damage in the long run. Recessions clear away some of the excess from the prior boom. Unproductive capital and assets go out of business and the economy pauses and restructures, stronger for the next leg up. That’s the textbook version.

However, in a world of massive leverage and unquantifiable debt, there may be no such a thing as a ‘purifying’ recession. 25 years of Greenspan-Bernake-Yellen-Powell Fed puts and excessive liquidity has built up so much private, corporate and especially sovereign debt in the system, that a recession and inability to service the debt would be enough to do some really serious and permanent economic damage. The Fed and Bankers know this - thus the desperate liquidity and printing we’ve seen nonstop for the last 14 years.

The massive and non-transitory inflation produced by our hysterical and incompetent response to the Covid crisis has further boxed in the Fed and accelerated this End Game.

So what we’re about to see in the short term is the Fed hiking rates into a slowing economy where much of the inflation coming on board now is due to supply crunch (broken supply chains and Russia oil, fertilizer and food assets off market) rather than excess demand.

In the medium term, the Fed will realize they can’t hike 7-11 times and remove liquidity into a slowing, debt burdened economy. When markets break and the elites start screaming this summer, expect the Fed to hit the gas on the liquidity pedal in the Fall as they realize their policy mistake thus driving speculative assets, real estate and inflation to all-time highs.

Rare Honesty from a Big Bank Analyst

I’ll chalk Zoltan Pozsar of Credit Suisse’s recent note up under the I never thought I would read something like this from a big bank category.

Pozsar predicts:

End of current monetary order

New dominance of "outside" over "inside" CB money

Inflation in the West

High treasury yields and dollar devaluation

Bitcoin to benefit, if it survives

Between Wall Street’s begrudging acknowledgement that we are witnessing a dramatic restructuring of the global monetary order, Biden’s Executive order on Digital Assets and recent Fed comments, it seems clear that bitcoin has at least another 6 months to fortify and build without state-level stress. More so, it is increasingly likely to be the basis as some sort of currency benchmark or backing along with gold and other assets that will compete with the dollar as a neutral reserve currency.

I don’t see the dollar being usurped as the global reserve currency anytime soon, but what people fail to realize is that it doesn’t take dollar replacement to have significant second order effects in the world. Pricing oil and other transactions in non-dollar currencies such as the yuan or rupee is unprecedented and happening now, and will have significant follow on inflationary and debt-service effects.

The reality of BTC as a viable, neutral global reserve currency is still years away but if anything, the last 2 months have massively increased the obviousness of the use case for Bitcoin - from the Trucker Rally in Canada to Ukraine. After the US Government literally shut down one of the most powerful nation states financial access to the global markets with a flick of the switch, it's becoming really obvious that there are only 2 paths forward for the world:

1. Central Bank Digital Currencies (CBDCs) - the basis for a nightmarish surveillance state panopticon where every life decision is subject to the state veto and approval aka digital slavery; or

2. Decentralized markets and money based on first principles of privacy, transparency and freedom.

The choice is ours.

Remember, if they can flip a financial killswitch on a nuclear power, what do you think they can do to you?

As Mark Jeftovic put it:

Thanks to Trudeau and Freeland setting precedent that a so-called Western G7 democracy can seize its citizens’ bank accounts with no due process and no appeal for the crime of demanding the reinstatement of their civil rights.

Thanks to the US government seizing the foreign reserves of another country (Afghanistan), not to freeze them until such time as democracy returns, but to actually redistribute them to their own citizens. Those funds were the savings of ordinary Afghan citizens who live under the Taliban, not as part of them.

And finally, thanks to the widespread weaponization of the SWIFT payment system against Russia, the seizure of Russia’s foreign reserves (approximately 100X the amount of Afghanistan’s), not to mention Russia’s implementation of capital controls against its own citizens (again, the ordinary citizens coming up on the short end of the stick).

We have experienced a rapid sequence of events that have forever altered the monetary, financial landscape globally, to wit:

Citizens can’t trust their own governments to protect their property rights, and

Governments can no longer trust each other to respect each other’s currency reserves

What we have here is the realization that absolutely no one can be trusted as a third-party intermediary for capital. There is really only one alternative to this situation: that is the mass adoption of a trustless, frictionless digital bearer instrument that can be accessed by everybody, everywhere, no matter what.

And that is Bitcoin.

I would add gold, commodities, livestock, farmable land, second passports, income producing businesses and other tradable goods and necessities to that mix.

Two is One, One is None.

Redundancy is the most important term for the remainder of the year.

There’s an old SEAL saying that, “Two is one, and one is none” meaning you better have a backup or you’ve got nothing. Expect things to break or be scarce.

In a world of broken supply chains and corrupt, anti-human governments, minimizing dependence and carefully exploring backups should be priority one.

Each of the centralized third party intermediaries we’ve come to rely on for our personal and professional lives can act as a killswitch on our activities - banking, transport, internet access, communications etc.

Explore alternatives and backups. Better yet, start implementing them at the core level of your day to day activities.

Child Abuse

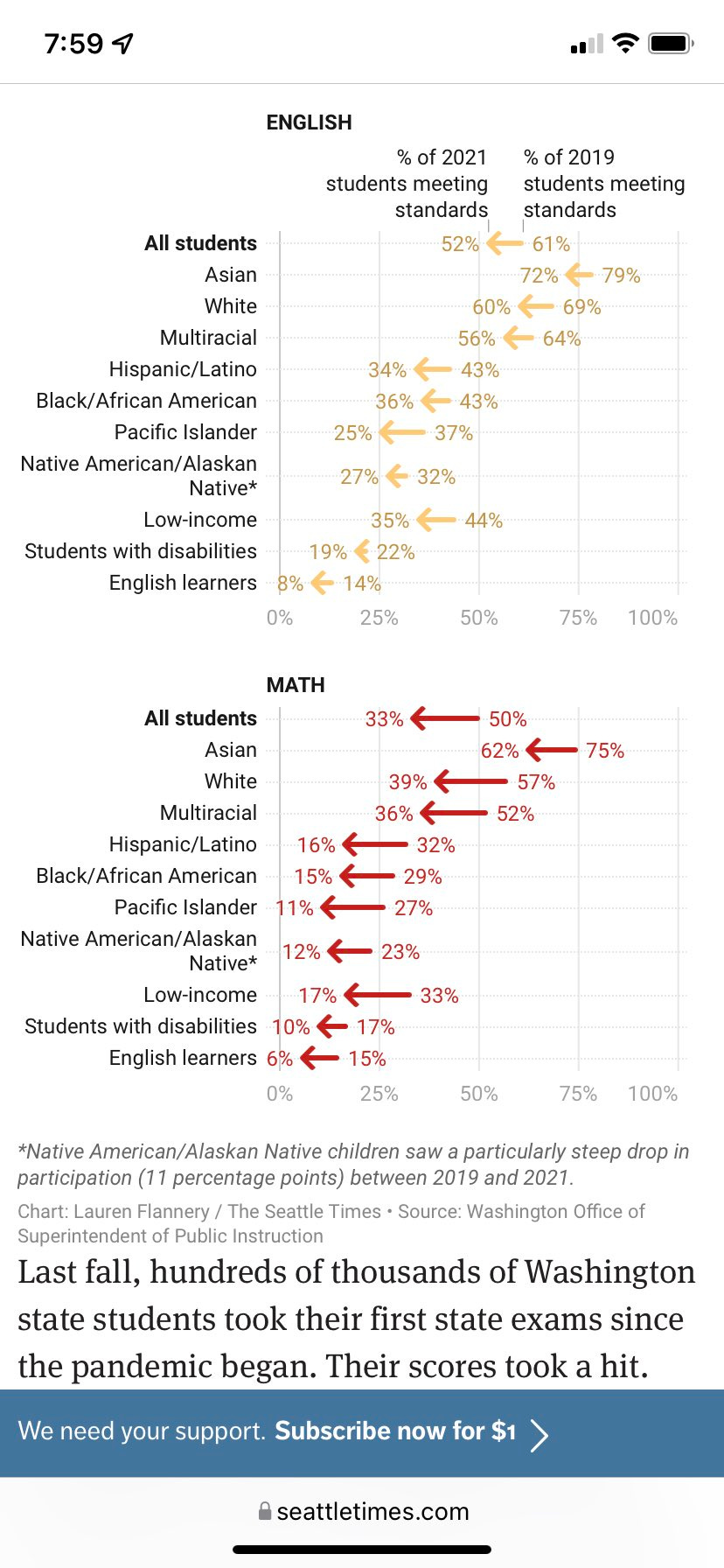

It’s rare that you see a single infographic that perfectly captures just a fraction of the abuse that was visited upon children from masks to school shutdowns over the prior two years. Here’s a graph of Washington state test scores 2019 to 2021. The results are devastating.

We needlessly damaged a generation with our folly as teachers unions, Democrats, Biden, Fauci, and the rest of the craven cowards put their own interest and safety above those of the children. Will there ever be accountability for the neglect of millions of children in blue states?

THE BRIGHT SPOTS

If we massively reign in the incompetence, stop the march towards a nuclear confrontation, and start making smart intermediate and long term moves as Trump did with energy independence, there's a chance we come out in a decent position on the other side after some deep pain.

The Globalization Dream is ending, and will likely be replaced by regional dominant trading blocs. Endemically high real world costs for food, energy and materials means economies will have to restructure around local solutions. The US is still blessed with the most defensible landmass (surrounded by 2 large oceans), ample natural energy and farmland…and relatively friendly countries to the North and South. If we can can get some sensible leadership and a consensus about the cost/benefits of real world solutions like domestic drilling, nuclear power, debt, money, freedom and privacy, we may be able to pull out of this terminal spin after all.

Perhaps a long shot, but not out of the question. Most people change not when they should, but when they have to. The economic and geopolitical realities coming due will leave us no choice and will take years. We can start now and the pain will be significant but manageable. Or we can wait until collapse….and chug the whiskey and bite the stick.

VARIANT VIEWPOINT: The Ukraine conflict has likely made China LESS likely to invade, not more as consensus originally indicated. The messiness of kinetic conflict illustrated by the Russia-Ukraine conflict is a firm red light signal for the CCP. The risks and drawbacks of a war with Taiwan is not worth it when they can ‘Hong-Kong’ the Taiwanese peninsula over the next decade. As America continues to weaken and sputter as a nation, China can continuously saturate the 'breakaway' island with money, propaganda and personnel to make Taiwan more amenable to a friendly unification (especially when they see what we did in Afghanistan and Ukraine and know they can’t rely on us any longer).

China can basically do the same thing they did here in the States to get kid glove treatment from the press and politicians over the past 20 years (from everyone except Trump), such as infiltrating media, universities and corporate C-suites. And Hong Kong Taiwan will fall under permanent Chinese influence without a shot being fired.

Braddock Blast

“Biden declared upon taking office, “America’s back,” which is only true if you define America as a government run by insane kleptocratic clowns whose problem-solving abilities amount to those of a farmer who sets fire to his cotton fields to drive out the boll weevils.”

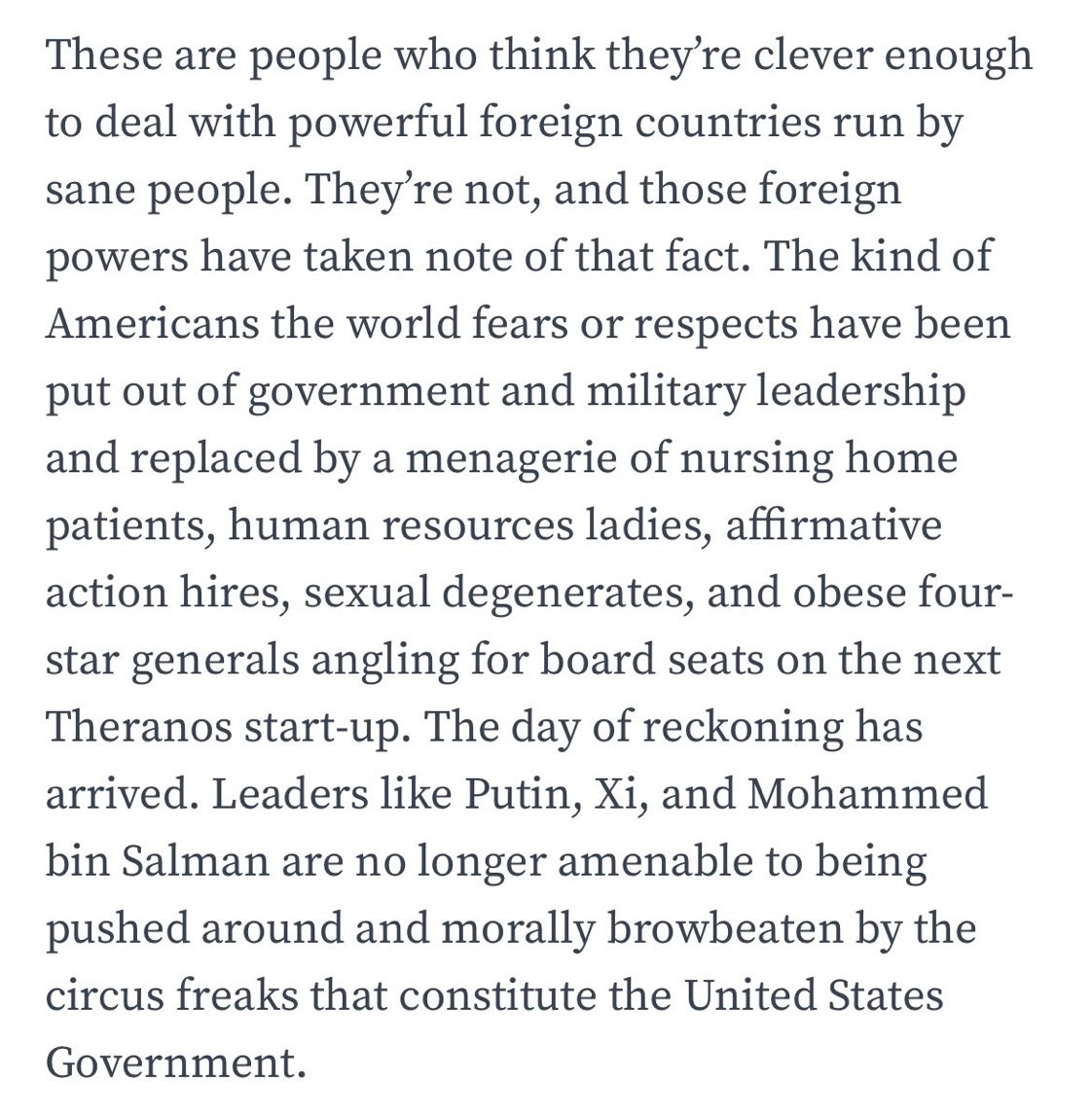

Ben Braddock comes out swinging in, ‘The Architects of our Current Disaster’. Money quote below.

Memetic Gold

Twitter Octagon

Parting Words

Stay strong. More people are waking up and expanding their consciousness faster than ever. And the numbers belong to our side.