The Acceleration Game continues. Change and rate of change continues to pick up velocity as the entire financial sector heads for a long overdue gut check.

This week saw some relative calm as the Federal Reserve met again and upped the Federal Funds Rate to 5%.

Compared to last week’s multiple banking collapses of SVB, Signature and Credit Suisse, no bank failures and bank runs was a welcome relief. However, under the surface, things continue to look troublesome.

Before we dive into things, take a moment to consider that the financial contagion we’re seeing is the same side of the coin as the political contagion we have seen and will continue to see going forward.

Most of our systems are based on lies and corruption. When those chickens come home to roost, they roost across the board. Nothing will be immune from the coming tide of disruption and sunlight. At least that’s our hope. If not, the world we’re facing is going to look very different to what we’ve been accustomed to in the last few decades. The clock is ticking…

Let’s start with the financial side before we turn to political games afoot.

Rock and a Hard Place

In the U.S. and globally, the financial system continues to be one giant mess. The ugly truth is, there is really no fix to the problems we find ourselves in. This is decades of bad policy catching up and the only real solution (like in the Great Financial Crisis in 2008) is to ‘kick the can’ down the road and pray that we can extend the shell game for long enough so that technology, aliens or some other Hail Mary comes out of nowhere to preserve our proximate standard of living without too much unncessary pain.

Either way, a ‘Reset’ is coming. The only two questions that matter are, “When?” and “What type?”

Will it be the WEF’s desired ‘Great Reset’? Where citizens are global serfs and those in power decide where you can live, what you can eat and the content you can consume?

Or will it be a decentralized, empowered ‘Truth Reset’, where the elites and other vampires that have enriched themselves at the expense of others are called to task and freedom and independence blossom.

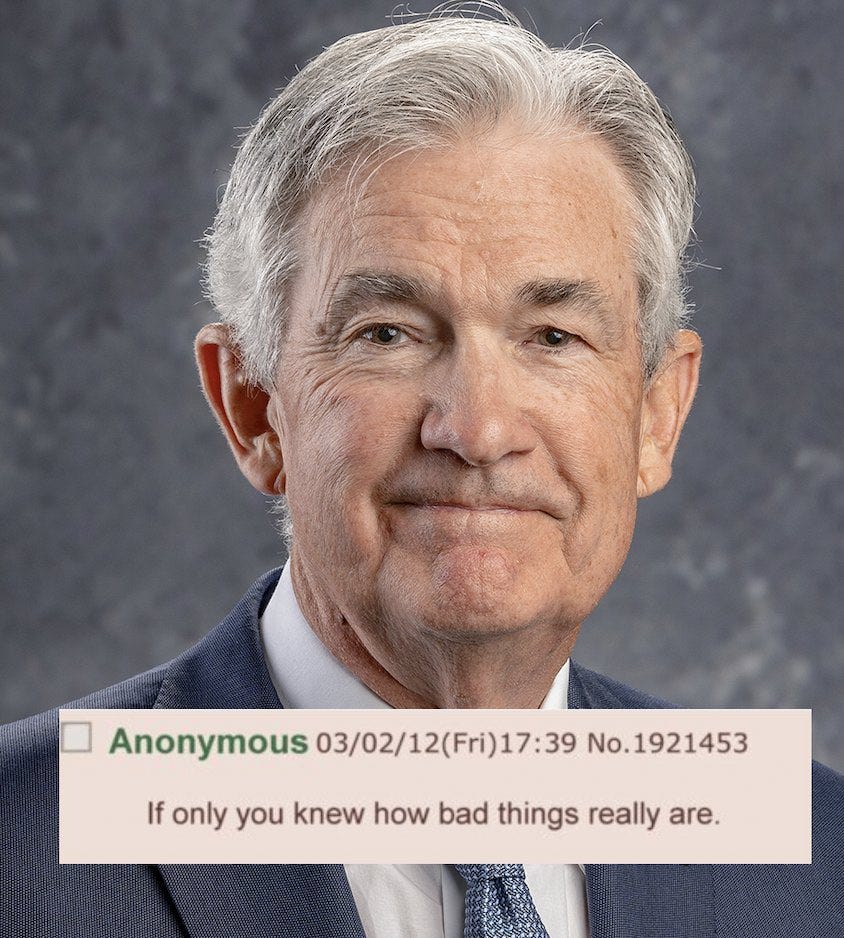

The ‘When” is up in the air. My best guess (and make no mistake, it’s a ‘guess’) is anywhere from 3 months to 7 years. While that range may seem imminent or soon, 5-7 years is literally a lifetime away with the pace of change and acceleration of technology. Almost no one has properly accounted for the monstrously disruptive impact Ai will have. Those who have, are scared shitless if they’re being honest and look like this privately.

Privately, I’ve had discussions with friends and clients regarding my belief the world will ‘end’ in the next 3-7 years. By ‘ending’, I don’t mean that it will go black and we all will be dead or cease to exist in our physical bodies (although that certainly is a possibility with our recklessness and stupidity with our war in Ukraine and government’s fetish for experimenting and designing new and deadly biological weapons of war).

I mean that the massive issues we are facing financially and geopolitically as well as the untold disruption that Ai and it’s ancillary technologies (DeepFakes) will produce in society will create a world that none of us will recognize in a very short period of time.

I pray that I’m wrong, and those that don’t know me well are right to laugh at the alarmism and forecast. However, those aware of my track record and past, know that I was dead on about the tech bubble, the real estate bubble, the Great Financial Crisis, bitcoin, the onset of Covid and dramatic fiscal and monetary stimulus that caused me to flip my bearish position in January 2020 to bullish in March/April of the same year.

More recently, they also saw my prediction and edict in October of 2021 to GET OUT of risk assets as I predicted a massive wave of inflation coming down the pipeline in the immediate future. By no means was I the only one predicting this, but I was certainly months (if not years) ahead of the Fed and most market commentators and saved you a boatload of money if you listened.

Back to my ‘world ending’ thesis. Think about the smart phone.

In the blink of an eye, mobile technology has transformed our world beyond recognition. Since its inception a mere decade ago, the smart phone and all the innovation that comes with it - social media, remote work possibilities etc.- have radically re-aligned society to create a reality unforeseeable just three decades prior.

Technology advancements have the potential to revolutionize our lives, but can also leave us feeling completely disoriented. In a few short years, Ai and global interconnectedness will create seismic changes leaving many of us feeling helpless in the wake of changes being wrought.

In today’s ‘might makes right’ system, truth is already under attack from all sectors. While fallible in many ways, the one giant thing Trump gifted the world was exposing the media as parasitical vipers. ‘Fake news’ became a part of our everyday vocabulary as we saw time and time again, that the so-called journalists and corporate media were nothing more than lying jackals spinning a narrative for their Deep State masters.

Case in point, which of these MSM hoaxes did you fall for?

The last decade has seen the rise of postmodernism and the decline of objective truth. Statements about ‘my truth’ or ‘his truth’ have become commonplace. The denial of basic biology and the rise of Pronoun Populism were additional arrows in the heart of veracity as people decided unilaterally that objective truth was only a mere option, and that ‘feelings’ were equivalent or superior to actual truth, science and logic.

Suddenly men could ‘choose’ to be girls, whites could choose to be black, and doctors could choose to ‘follow the science’ despite overwhelming and obvious objective evidence to the contrary.

Self-indulgent subjectivism or objectivism led to our current intersectional Victim Olympics and the denial of basic, traditionalist truths that had served society well for the last few thousand years.

Frighteningly, Ai has the potential to destroy the last remaining vestiges of truth and evidence.

How do we know a video is real when Ai has the capability to render a believable image before our very eyes? How do we know a phone call is actually our friend or family member when Ai can create a perfect voice from any subject? How do we know a document, a picture, a recording is ‘real’ when it can be cloned or created from scratch and be virtually indiscernible from the legitimate original?

These are just some of the challenges we face ahead, not to mention mass unemployment and financial disruption due to bad public policy and overleverage.

Ok. Now that I’ve cheered you up, let’s look at the carnage going on in the financial sector underneath the surface.

While the equities markets have been somewhat stable for the last few months, underneath the surface there has been signficant volatility and carnage.

Short-term treasuries have has some of the most violent moves in my 30 years of watching markets.

The massive swings in bond markets — particularly in U.S. 2-Year Treasury yields — reveal the magnitude of moves relative to other times of crisis. As the chart above indicates, volatility in 2-Year Treasuries is significantly greater than during COVID, and rivals that of the 2008 Financial Crisis.

Volatility is a measure of the rate of fluctuations in the price of a security over time. It indicates the level of risk associated with the price changes of a security. Investors and traders calculate the volatility of a security to assess past variations in the prices to predict their future movements. In other words, high volatility means big expected future changes in price.

The lack of confidence in our leadership and the solvency of the banking system is leading to a flight of assets from smaller banks to big banks. Secretary of the Treasury Janet Yellen’s failure to guarantee uninsured deposits from small banks (only the TBTF banks get this bonus) means that logical depositors/investors will move money from those small banks to the bigger ones thus creating a self-fulfilling prophecy of banks runs.

Whether this is intentional or not, remains to be seen. Pattern recognition is one of the keys to successful investing, and there’s a part of me that thinks this scenario resembles the destruction of small businesses in favor of big box stores that we witnessed during our inept and democidal response to Covid.

Remember when the government unintentionally, incompetently or deliberately destroyed hundreds or thousands of small businesses and drove big box retailers like Target and Walmart to all time highs during Covid?

We could be seeing a similar, selective ‘mistake’ here with small banks and the ‘Too Big to Fail’ banks.

Depending on whether uninsured depositors of banks besides Silicon Valley Bank are offered some relief, we could see a widespread systemic bank run in nearly all non-systematically important banks.

The contagion effects would be economically devastating, but it would accomplish at least one benefit for the US Security State.

By funneling most domestic deposits into a handful of TBTF banks, it makes the rollout of CBDCs a lot easier to orchestrate.

Coordinating the CBDC logisitics for a dozen or so large, centralized banking franchises is much more palpable than trying to do it with thousands of small, regional banks, credit unions and other commercial banking outposts.

I’m not saying this is going to happen or whats’s happening (or even that the depositors don’t deserve some type of haircut for practicing poor risk mgmt), just that we’ve seen too many ‘coincidences’ and conspiracies in the last 3 years come true to ever trust the system and disregard asking the tough questions.

Without an explicit system wide guarantee of depositor safety (what else are banks for really if you can’t be assured that the money you have there is safe?), here’s what the ensuing months will look something like this:

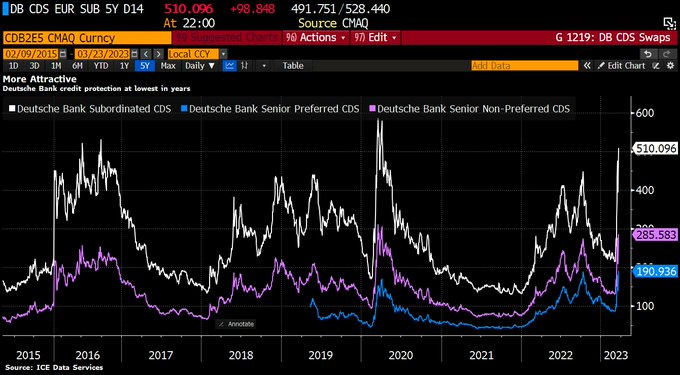

Deutsche Bank and Powell’s Poker Face

The most important chart of the day is the Deutsche Bank CDS chart (above) and the most important video this week that everyone missed is Chair Powell's terrible poker face.

For those familiar with reading body language, take a look at the series of 'tells' Powell exhibits when asked a question about the Credit Suisse deal at the presser post-Fed interest rate meeting.

In poker that’s called a “pacifier tell”. People do it to comfort themselves. It usually signals weakness for instance when someone is bluffing.

I'm going to simplify this tremendously, but with regard to the Deutsche Bank CDS chart above, healthy debt trades at 'par', or 100 cents on the dollar. When the debt starts trading lower, it's usually because there is some financial distress of the company and doubt about its future and ability to service its debt.

CDS, or credit default swaps, are basically a measurement of a firm's 'health'. If the company or their bonds are 'distressed' (selling at a discount bc traders/investors don't believe the company will be able to make the payments that are due), then investors can purchase CDS to 'insure' against loss (or just to speculate and make a bet the company will go bankrupt as many astute traders did during the Great Financial Crisis as popularized by the movie, “The Big Short.”).

To 'swap' the risk of a default, the lender buys a CDS from another party who agrees to pay them if the borrower defaults.

Most CDS contracts are maintained via an ongoing premium payment similar to the regular premiums due on an insurance policy (I pay X monthly and if my house burns down I get 100% of the insured amount).

The spread of a CDS indicates the price investors have to pay to insure against the company’s default.

In exchange for the money put up (premium), the investor is granted a 'swap' which is a financial instrument in this case that theoretically moves inverse to the health of the subject company.

So while a relatively healthy company may trade at 10, a distressed company will trade much higher. For example, Deutsche Bank is currently trading at 208.

Credit Suisse, before it was halted, was trading at 240. As you can see from the chart, Deutsche Bank (DB) credit default swaps spiking higher indicates an increased probability that DB will default on its debt and need a rescue (yes, it's 'too big to fail' and the German poster bank so I would expect a rescue rather than a free market failure).

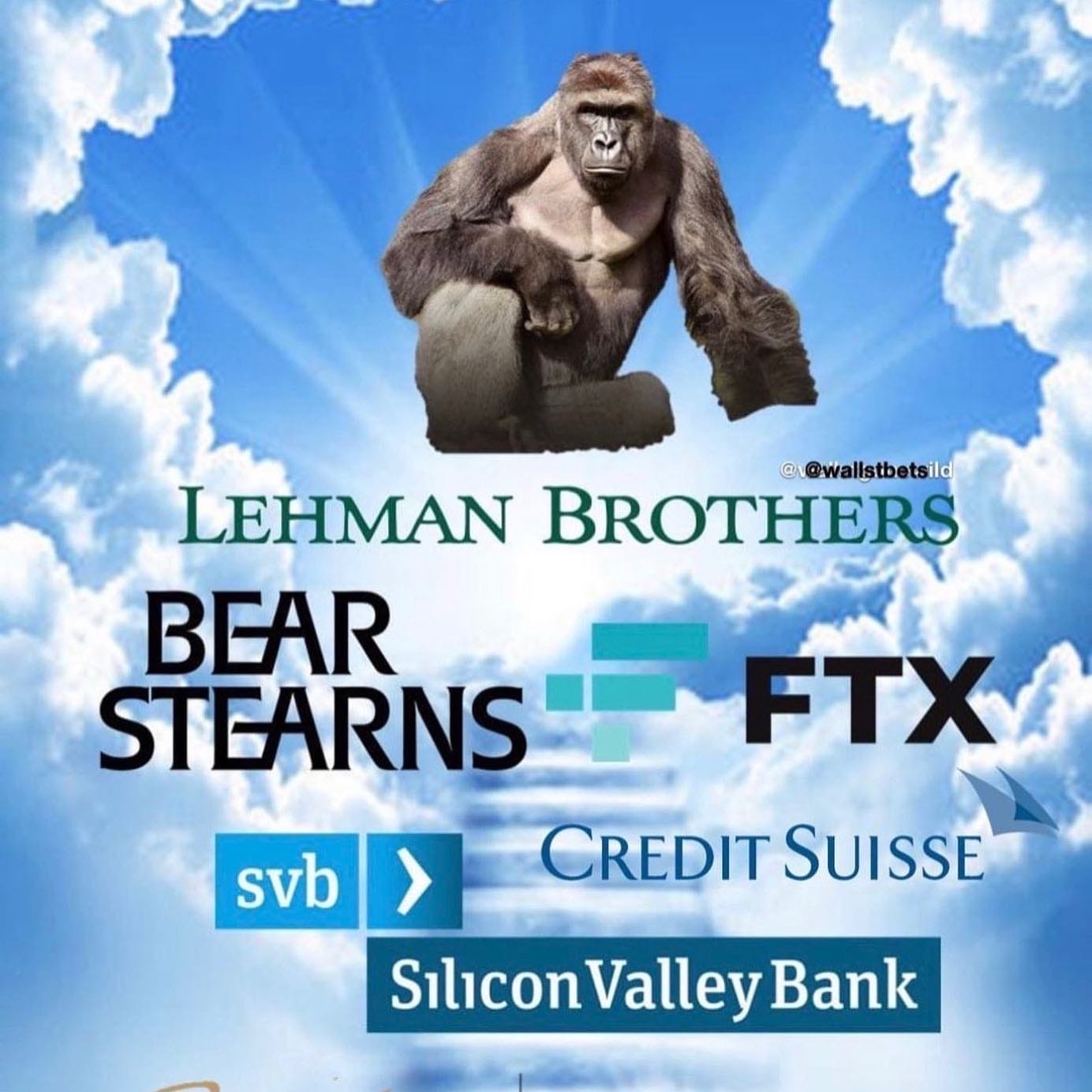

Every bank failure from Bear Stearns to Lehman to Credit Suisse (and everything in between) is telegraphed by investors/traders rushing in to buy credit default swaps.

CDS are like the heartbeat of a company, and right now some of those readings are in arrhythmia.

To add gas to the fire, we watched UBS and the Swiss Government bail out Credit Suisse last week to prevent a much wider and more serious meltdown of markets (Credit Suisse is approximately comparable to Lehman Brothers in size and exposure).

While many breathed a sigh of relief that the Credit Suisse rescue was executed flawlessly last weekend, it appears based on Powell's answer to a journalist's question that the Credit Suisse deal might not be completely cemented.

If it were to unravel, we'd be in for a lot more pain and failures in the global banking sector (the ugly truth is the financialization of the American and global economy and the interconnectedness of all these banks due to derivatives and other complex instruments is massive).

All it takes is a loss of confidence for the whole game of Jenga to unravel.

In finance, confidence is paramount.

Do you have confidence when TreasSec Yellen speaks?

Do you feel confident when the Demented Puppet 'speaks'?

So buckle up as I've been warning for the last 18 months, we're still at DefCon 2 here.

Swim at your own risk.

France - Macron and What’s Coming

Globally, we’re seeing continued momentum in the pushback against totalatarianism and WEF kleptocrats.

Twitter, citizen journalists, dissident doctors and scientists have successfully woken up much of the world to the fraud and corruption that took place while pushing the response to the pandemic including the ineffective and highly dangerous Covid ‘vaccines.’

While there is much work still be done to hold these architects and their useful idiots in the press and public responsible, it is encouraging to see French citizens take to the streets to push back against French President and WEF stooge Emmanuel Macron.

Macron tried to unilaterally raise the retirement age in France from 62 to 64, and the French ‘yellow jackets’ and other citizens weren’t having it to put it mildly.

Dutch citizens have also taken to the streets to protest the Climate Change fanaticism that is being used as a front to confiscate farms and equipment.

You probably won’t see this on TV, but as the protests and riots continue, King Charles III's state visit has been postponed due to the kinetic situation throughout the country. Macron and other officials have begun to crack down on demonstrations as the rioting and arson has expanded significantly, threatening key governmental agencies and buildings.

On a separate note, many of the police officers tasked with quelling the uprising have joined in the protests. It’s a beautiful thing to see.

Just imagine if the NYPD had showed this type of courage instead of happily arresting children and their parents for trying to eat in a Burger King without an experimental injection during the Scamdemic. #Cowards

And here we have a wonderful image of real life merging with Memeville….

Stanford Free Speech Lesson

Whether it’s ‘Trans Rights’, Drag Queen Story Hour, the Covid Vax cover-up or the tantrums of Gen Z and Millennials over Free Speech and dissenting viewpoints, the pendulum is continuing to swing back to the Good Guys and Constitutional first principles.

As I wrote about recently, Federal Judge Kyle Duncan was jeered and interrupted by about 100 students when he was invited to speak at Stanford in early March by the Federalist Society.

“Let’s say the quiet part out loud: The mob came to target me because they hate my work and my ideas,” said Judge Duncan, a Trump appointee, in his Friday address at Notre Dame’s Center for Citizenship & Constitutional Government.

“None of this spectacle, this obviously public shaming, had the slightest thing to do with free speech,” he said. “It had everything to do with intimidation. And to be clear, not intimidating me. I’m not intimidated by this. I’m a life-tenured judge. I’m going to go back to my court and keep writing opinions. No, the target of the intimidation was the protesters’ fellow students.”

Immediately after Judge Duncan’s appearance, the dean of Stanford Law School Jennifer Martinez issued an apology to him which merited further uproar and protests from the same triggered students. While some students believed they had successfully shamed Dean Martinez into retracting her apology and supporting them, the letter she released below wasn’t what they were expecting.

I recommend reading the entire thing. Hopefully the entitled children at Stanford read the letter as well and recognize the irony of studying the law and Constitution while simultaneously doing their best to eviscerate the First Amendment and other keystones of American jurisprudence.

Obviously, they won’t. They didn’t go to law school to defend the Constitution, but to rewrite it to suit their own needs and feelings and to trample on the First Principles that made our country great in the first place.

Letter from the Dean.

Hopefully, next time they get a spanking or ‘timeout’ as well as a lecture.

Milk Carton Fetterman

Just when you thought things couldn’t get any stranger. In a move that makes the Damar Hamlin case seem ‘normal’ and that further makes me doubt the competency and integrity of Republicans and conservatives everywhere, this week treated us to more silence and questions regarding the strange case of the disappearance of Pennsylvania John Fetterman.

It’s bad enough that the dipshits of Pennsylvania chose to elect a metaphorical brain dead corpse to the U.S. Senate, but what’s even more bizarre is why with the fate of the Senate majority hanging in the balance, the Republicans haven’t capitalized on the obvious death or incapacitation of this oxygen-challenged ogre.

As I wrote about last month, after Fetterman’s recent stroke or “depression” and hospitalization, his wife Gisele decided to take her children and flee to Canada instead of staying by her husband’s hospital bedside. That alone should have been a front page story and clue for these Colombo Republicans that something was amiss.

It’s now been over a month, and no still one has seen or heard from the real John Fetterman.

Whether the image below is true or not, we all know this would be front page news day in and out if the roles were reversed and a ‘sick' Republican was missing in action for 6 weeks with the fate of the Senate Majority hanging in the balance.

How about the House Republicans start taking this game seriously and demand proof that Fetterman is alive. Clearly, the Democrats are hoping the facade can last until April 18th when they will have the right to support his successor instead of calling a general election to fill the vacant seat.

On that note, has anyone seen Diane Feinstein lately???

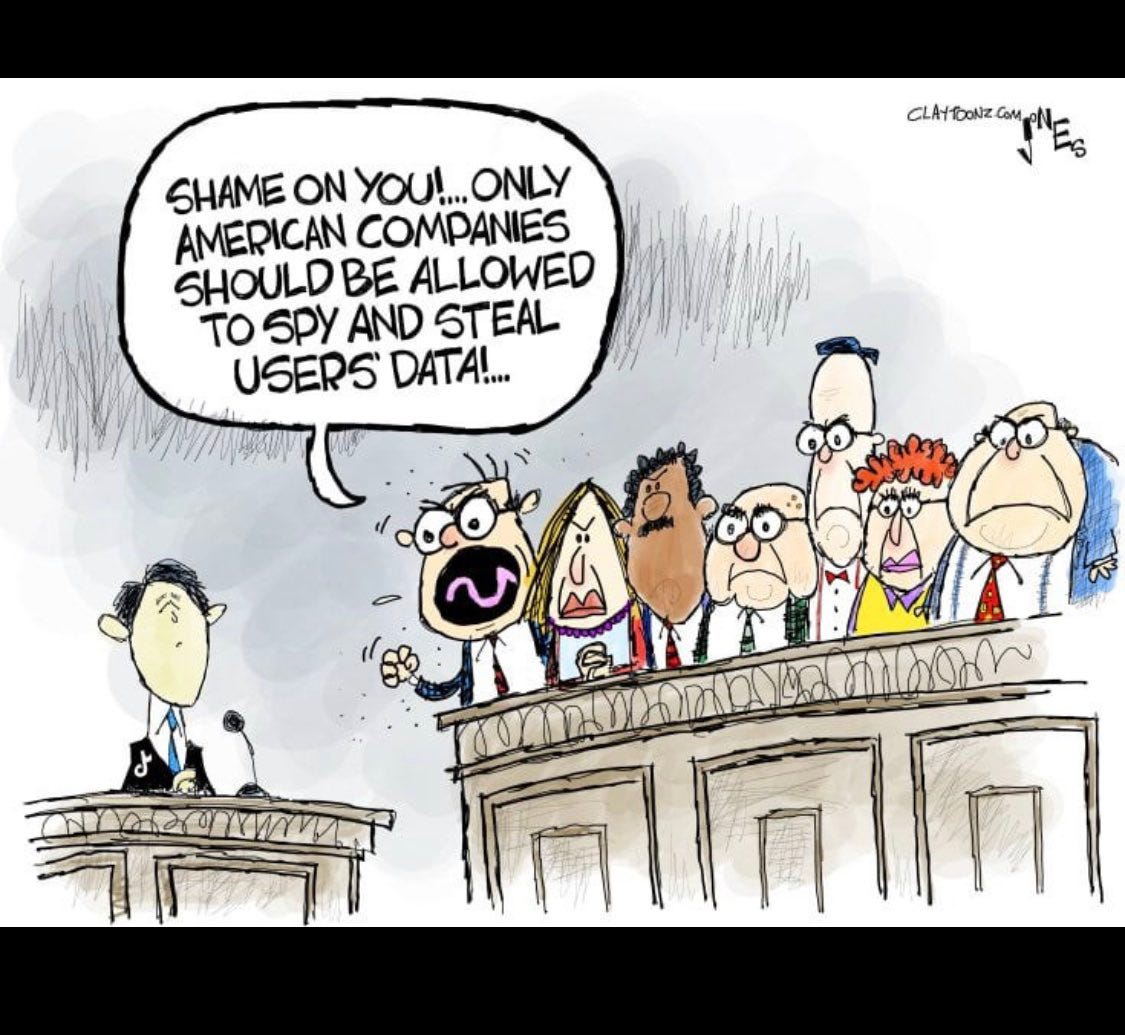

Tik Tok

Congress is currently holding hearings on whether to ban Tik-Tok.

The thesis we hear repeated again and again is that Tik-Tok gives the Chinese access to your data.

Two things. First, why are people suddenly so worried about Tik Tok tracking their data?

Facebook, Amazon, Google and damn near every other social media app have been documenting, stealing and selling your personal photos and private information for over a decade and all we’ve heard from the peanut gallery in Congress is crickets.

Second, this isn’t even the real risk of Tik-Tok. The real risk is the heat algorithm which highlights certain content to go viral or appear in feeds. Allegedly, in China the algorithm highlights science, math, education and other ‘net positive’ content to be fed to subscribers.

In America, it’s often the opposite. Teenagers doing booty dances, dumbed down destruction or racial violence, videos emphasizing stupidity or mental illness like gender dysphoria.

The targeted dissemination of this ‘anti-propaganda’ rather than data access is the real scandal. So why is Congress and all of these other critics highlighting the data part? It’s unclear, but it certainly bears watching.

Finally, and most controversial, I’ll say it here in the clearest, loudest possible terms.

I like Tik-Tok because it’s one of the few platforms where you have some semblance of free speech. Facebook, Instagram, LinkedIn and certainly Twitter pre-Musk was little more than a Deep State narrative enforcer that would censor the truth and parrot the Regime party line.

Many will scoff, but the ugly truth is - China is less of a threat to your average American than our own government.

Don’t get me wrong. I DESPISE the Chinese government and think they’re one of the greatest threats to freedom and world peace (perhaps even more than our own government).

But China wasn’t the one that tried to mandate me and my children be forcibly injected with an experimental toxin, and then ban us from society when we refused to comply.

China wasn’t the one who started and prolonged a needless war in Ukraine that has potential global nuclear war implications.

And China isn’t the one listening to every phone call, text message, social media posting and other communication between Americans. No, that’s the NSA, the FBI and our own government.

The real reason they hate Tik-Tok is because it’s beyond the censorship and data collecting reach of our own intelligence agencies. That’s the truth. The rest is just theater.

Kari Lake Wins One for the Gipper

Kari Lake, former Republican candidate for governor in Arizona, recently went to trial in Maricopa County Superior Court on the issues of missing ballot chain of custody and Election Day machine failures in the 2022 midterm election.

Lake's initial filing demanded an opportunity to inspect Maricopa County ballots from the 2022 general election, including ballot signature envelopes and corresponding signatures, before the trial. However, Judge Peter Thompson dismissed eight of ten counts before trial includeding the count regarding fraudulent mail-in ballots and failed signature verification, which was perhaps the most critical count.

The Gateway Pundit reported on bombshell allegations made by whistleblowers in Lake's lawsuit that Maricopa County officials allowed tens of thousands of mail-in and drop box ballots that did not satisfy signature verification requirements to be counted.

Arizona Attorney General Mark Brnovich (can somebody buy this guy a vowel??) released a report in April 2022 agreeing that the early ballot affidavit signature verification system in Arizona, particularly when applied to Maricopa County, may be insufficient to guard against abuse.

The Attorney General also stated that requiring a match between the signature on the ballot affidavit and the signature on file with the State is currently the most important election integrity measure when it comes to early ballots.

Coupled with the alleged missing chain of custody documentation for hundreds of thousands of ballots, there is no way of knowing how many fraudulent ballots were inserted into the system and accepted with fraudulent signatures.

This missing count in Lake's lawsuit could reveal the true fraud involved in the vote-by-mail system. Although Judge Thompson dismissed eight of ten counts in Lake's lawsuit, the two remaining counts related to the missing chain of custody documentation and the disgusting and obviously preplanned Election Day machine failures. The outcome of the trial is still pending, but it could have significant implications for future elections in Arizona and beyond.

Moving forward, it is essential that we continue to prioritize the integrity of our election process and work to address any vulnerabilities or weaknesses in the system. This includes implementing robust verification procedures, investing in new technology and infrastructure, and ensuring that all eligible voters have access to the ballot.

Kari Lake's win at the Arizona Supreme Court is a victory for all those who believe in the importance of free and fair elections. Let us continue to fight for the integrity of our democracy and ensure that every voice is heard.

Fat Alvin

Well, well, well…it looks like House Republicans are finally taking action against bountiful Manhattan DA Alvin Bragg, who has been shamelessly abusing his power in his crusade against former President Donald Trump.

It's no secret that Bragg has been on a mission to take down Trump at any cost, even if it means elevating a questionable misdemeanor to a felony in the Stormy Daniels case just to "get Trump."

Even Bragg’s wife was caught recently in compromising posts as old tweets resurfaced regarding Trump.

But now, it seems like the tables have turned, and it's Bragg who is in hot water.

House Judiciary Committee Chairman Jim Jordan, House Oversight Committee Chairman James Comer, and House Administration Committee Chair Bryan Steil have had enough of Bragg's shenanigans and have demanded testimony and documents related to his investigation into the so-called "hush payment" case.

It's clear that Bragg's actions are politically motivated, and he's just trying to score some cheap points with his far-left supporters. But elections have consequences, and now that the Republicans have the House it’s at least a speed bump for far-Left Democrats trying to run roughshod over the Constitution.

Of course, Bragg tried to deflect blame and accused Trump of starting rumors about his imminent arrest. But we all know the truth – Bragg's case is faltering, and he's desperate to save face.

And let's not forget that Bragg is trying to prosecute a federal matter out of the state of New York, which is a clear overreach into local matters. It's about time House Republicans called him out on it.

In the end, perhaps justice will prevail, and Bragg will have to answer for his abuse of power. It would be deliciously ironic if Bragg loses his career and job over a political witch-hunt that was neither necessary nor a judicious use of taxpayer resources.

After all, it’s not like there’s a major crime wave in New York or anything that might need attention from those elected to provide safety for the citizens of this once great city.

Things I’m Reading & Watching…

Moderna: A Company in Need of a Hail Mary.

People Can Win by Matt Taibbi. We've been trained to think that endless rule by tiny minorities of really horrible people is the natural order of things, but that turns out to be just another lie.

Operation Choke Point 2.0 Is Underway, And Crypto Is In Its Crosshairs by Nic Carter.

Ray Dalio: The Changing World Order. Worth a rewatch if you’ve seen.

Sparks of AGI in GPT4 Paper explained in a 12 min video.

Best of the Twitter Octagon

Memetic Warfare

Parting Words...

We're called to love, no matter what. The challenge is to keep love in your heart, even if they kill you for it. - Chance Lunsford

That’s it for this week friends. Hit the like button up top, share it with a friend, and enjoy your Sunday sovereigns!