The phrase ‘off the bus’ hails from the psychedelic haze of the 1960s, born on Ken Kesey’s Merry Prankster bus, Furthur, a roving commune of LSD-fueled rebels chronicled in Tom Wolfe’s The Electric Kool-Aid Acid Test. To be “on the bus” meant you were all-in for the Pranksters’ mind-bending, norm-shattering quest; “off the bus” marked those who couldn’t hack the vibe or got the boot. Musk, like a modern-day Prankster gone rogue, hopped aboard Trump’s MAGA express only to find his wild ride come to a screeching halt after a flameout for the ages, his vision of techno-utopian influence no match for the political road’s sharp curves.\

Let’s break down why, and what it means.

The Big Beautiful Battle: Trump, Musk, and the Fight for America’s Soul

The clash between President Donald J. Trump and Elon Musk over the Big Beautiful Bill (BBB) has ignited a firestorm, exposing fault lines in the fight for America’s economic and cultural future. This isn’t just a headline-grabbing policy spat—it’s a high-stakes showdown over priorities, power, and the path to national renewal. This bill, the cornerstone of Trump’s second term, is a bold bid to secure the border, cement pro-growth tax cuts, and unleash a transformative economic boom. Musk, the greatest entrepreneur of our time, has called it a fiscal disaster, erupting in a public tirade that culminated in a now-deleted smear. The stakes are existential: pass the BBB, and America seizes a once-in-a-generation chance to restore sovereignty and prosperity; kill it, and we risk economic stagnation, political paralysis, and a victory for the forces of decline. Let’s cut through the noise, reason from first principles, and chart the path to victory for Team USA.

The Economic Engine: A Boom Worth Fighting For

The BBB is no ordinary legislation—it’s a high-octane engine for growth and security. The numbers are undeniable. The S&P 500 is charging toward 6,000, the Dow is nearing 43,000, and Q2 2025 GDP is projected at a robust 3.8%, per the Atlanta Fed. Blue-collar wages are rising at 4.2%, doubling the sinking 2.1% inflation rate, while unemployment holds steady at 4.2%. The Congressional Budget Office (CBO), despite its partisan leanings, projects Trump’s tariffs will generate $3.1 trillion over a decade—enough to fund permanent extensions of the 2017 tax cuts, full expensing for businesses, and unprecedented investment incentives. These policies fueled 3%+ growth in Trump’s first term, and they’re poised to ignite Boom 2.0, or at least maintain our current growth trajectory in the face of mounting headwinds.

But the bill’s true power lies in its immigration provisions. The border crisis—20 million illegal crossings under Biden, costing taxpayers $450 billion annually in healthcare, education, and crime[1] —is the existential threat to American sovereignty. The BBB funds border enforcement, deportation, and remigration without needing a single Democrat vote. As a reconciliation bill, it requires only 51 Senate votes, making it the most viable path to deliver on Trump’s landslide mandate: secure the border, stop the chaos, and restore the Republic.

Yet, storm clouds loom. The consumer is maxed out, with savings evaporating and student loan payments back. It’s still a large question market whether tariffs will hurt trade. The real estate market is wobbling post-COVID stimulus, and a jobs bloodbath looms. McKinsey and Goldman Sachs warn that AI could displace 10-15 million jobs by 2027, potentially pushing unemployment to 10% within two years. Without pro-growth policies, these headwinds could stall the boom. The BBB’s tax cuts, deregulation, and tariff-free investment incentives for those who build here are non-negotiable. Goldman Sachs predicts $1 trillion+ in foreign direct investment by 2028, drawn by low taxes, minimal red tape, and cheap energy. This is America’s chance to turn the ship around—but it’s not a second shot.

The Fiscal Abyss: Musk’s Warning and Misstep

Elon Musk’s eruption against the BBB—calling it a deficit-exploding disaster—stems from a grim reality: America’s fiscal trajectory is a ticking time bomb. The national debt stands at $36 trillion, with unfunded liabilities exceeding $120 trillion, per Truth in Accounting and other sources. Interest payments are projected to hit $1.2 trillion annually by 2030, crowding out other spending. Musk’s Department of Government Efficiency (DOGE) has pushed for cuts, but Congress’s refusal to act—coupled with the axing of Tesla’s $7,500 EV tax credit—pushed him to the edge. His now-deleted tweet implying Trump’s ties to Epstein was a catastrophic misstep, alienating allies and torching his insider status.

The essential truth buried beneath all the noise is this: everything flows downstream from culture. And culture cannot survive without borders. If we don’t fix immigration first—if we don’t stop the bleeding—we won’t have a nation left to budget for. No fiscal reform, no entitlement restructuring, no economic strategy matters if the very fabric of the country is being unraveled in real time. Secure the culture by securing the border—or forget the rest.

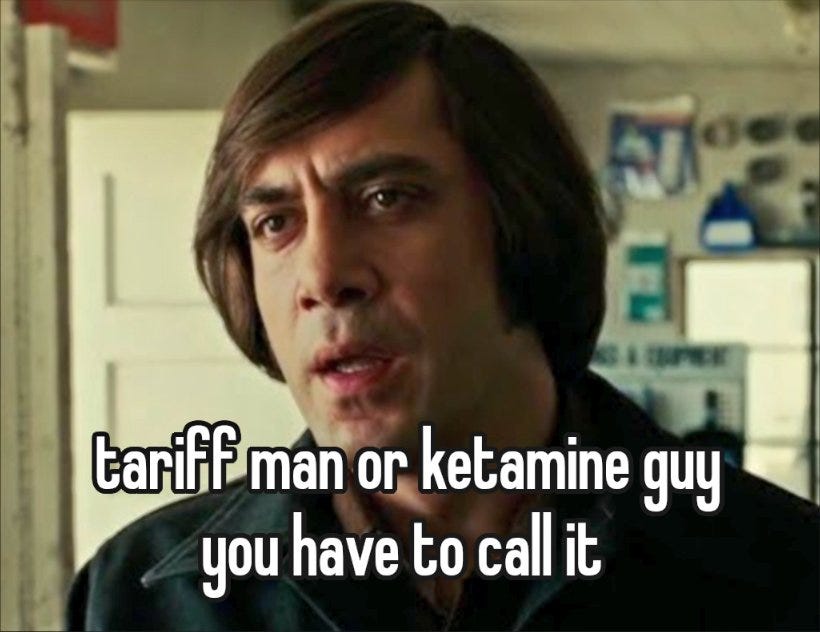

Naval Ravikant put it perfectly below.

Musk fixated on the former while misjudging the urgency of the latter.

Musk’s critique relies on static CBO scoring, claiming the BBB adds $2 trillion to the deficit. But this ignores dynamic scoring—accounting for growth-driven revenue. The 2017 tax cuts, projected to cost $1.9 trillion, added just $600 billion to the deficit after spurring 3% growth, per the Tax Foundation.

The BBB’s $3.1 trillion in tariff revenue and $1.7 trillion in mandatory savings could slash the deficit by $8.5 trillion over a decade, per GOP estimates (depends on 3% GDP growth, but even if you back out that $4T entirely, there is still $4.5T in deficit offset – more than enough to make the Trump Tax Cuts permanent).

Musk’s failure to acknowledge this undermines his case.

Worse, his public meltdown—airing grievances like a jilted teenager—cost him more than he realizes. Trump doesn’t need Musk; Musk needs Trump. Tesla, SpaceX, and Starlink rely on federal contracts and favorable policies. Shareholders would revolt if Musk’s antics jeopardized those, and the security state could crush him. His olive branches, offered after what was likely panicked calls from his various Board members, may save his companies but not his seat at the table or on the bus.

The Bill’s Flaws: Fixable, Not Fatal

The BBB isn’t flawless. Two issues stand out. First, restoring the State and Local Tax (SALT) deduction to $40,000, capped at $10,000 in 2017, is a $600 billion mistake over a decade, per the Tax Policy Center, subsidizing high-tax blue states while offering little to red-state voters. As Charles Haywood poignantly noted, “I don’t care about “wasteful” or “excessive” government spending. That ship sailed long ago. I want spending, and actions embedded in spending bills, that helps my friends and hurts my enemies (and their plans). Everything else is irrelevant.”

Here here Charles. 🥂

While the SALT cap would hurt me personally, there’s no reason to reward TDS blue state NPCs who fought tooth and nail for Biden’s destructive tendencies and against Trump over the last decade. Let them shoulder the consequences of their indoctrination and irrationality.

Second, the bill’s Pentagon spending hike—pushing defense budgets near $1 trillion annually—lacks a mandated audit or a shift to asymmetric warfare. Cyber threats and drones are the future, yet bloated programs like the F-35, with $10 billion in cost overruns, per the GAO, persist. A leaner $800-850 billion defense budget, including border security, would suffice. These flaws fuel skepticism, but they’re not reasons to tank the bill—they’re reasons to pass it and refine later.

The Political Reality: Perfection Is the Enemy of Progress

Libertarian holdouts and faux conservatives argue the BBB doesn’t cut enough. They’re not wrong, but they’re missing the bigger picture. This is a reconciliation bill, passable with 51 Senate votes, not a fantasy requiring 60. Blocking it hands Democrats and Never-Trumpers a win, crippling Trump’s political capital before the midterms.

The Libertarian candidate, running on a Randian platform, secured just 0.5% of the national vote in 2024. More significantly, in 2020, the Libertarian Party drew nearly 3% of the popular vote—more than enough to have tipped the election to Trump had they shown a measure of strategic realism and rallied behind him in the general election. Instead, their ideological purism played spoiler, helping deliver the presidency to Biden.

America didn’t elect Trump for austerity—they chose him to secure the border, end cultural insanity, and restore economic vitality. The BBB delivers on those promises to thunderous applause from the campaign trail.

Plato warned that democracies reward short-term goodies over long-term discipline. Congress proves it, with budgets nearly doubling to $6.8 trillion in a decade. Politicians, enriched through insider trading and murky deals—consider AOC and Elizabeth Warren, whose net worths ballooned from $250,000 salaries to tens of millions—have no incentive to cut. The media, 95% Democrat-leaning, amplifies every reduction as a crisis. Trump’s team knows unilateral cuts are politically toxic without bipartisan buy-in. The fiscal Rubicon has been crossed—revenue hit $5.3 trillion in 2024, per the Treasury, but spending is out of control.

The Only Way Out: Grow and Inflate

As Lyn Alden warns, “Nothing stops this train” (see below for more). Democracies don’t cut spending; the Romans couldn’t, and we can’t either. The only path is to grow and inflate our way out. Spend smarter, not less. Leverage AI and energy breakthroughs to supercharge productivity. Inflate liabilities through strategic currency debasement. The debt—$36 trillion and counting—won’t be paid back; it must be made manageable. A bipartisan blue-ribbon commission could shield tough choices: means-test Social Security, raise the retirement age, cut illegal immigration’s $450 billion annual cost, and trim 10% across departments. DOGE’s efficiency gains and tariff revenue could close the gap. But the bond market is the real threat. Jamie Dimon warns a spike in long-term rates to 6-8% could tank our leveraged economy. Printing money to buy Treasuries, as post-COVID, fuels asset inflation, eroding wealth.

But let’s be real for a moment. Elon and other deficit hawks talk of “bankruptcy” is absurd. The dollar, a debt-based currency, can be printed endlessly at the touch of a button. The risk is inflation eroding purchasing power, as it has for a century. Yet, there’s hope. Artificial Super Intelligence and robotics could slash costs for energy, housing, food and other goods per McKinsey, creating abundance. Kicking the can a decade might work—if we avoid a bond market meltdown.

Trump vs. Musk: A Clash of Titans

Musk’s outburst wasn’t just policy—it was personal. He sacrificed time, money, and reputation to back Trump, only to see DOGE sidelined and Tesla’s EV credit axed. His frustration boiled over, but his approach—demanding the bill’s death and spreading baseless Epstein claims—was a strategic disaster for the ages. Pros settle scores behind closed doors. Musk needs Trump far more than Trump needs him. If he threatens to withhold critical technologies, shareholders or the security state could intervene. Over half the country roared for Trump’s agenda—border walls, tax cuts, energy dominance—not Musk’s fiscal sermonizing.

The Path Forward: Unity for Team USA

This isn’t about egos—it’s about America’s soul. Musk, the greatest entrepreneur alive, is right about the debt spiral. Trump, the most consequential president since Reagan, is right about the border and growth. Both must unite. The BBB is imperfect but transformational, delivering on promises that won a landslide: secure the border, deport illegals, dismantle gangs, unleash energy, reshore manufacturing, and end taxes on tips, overtime, and Social Security. Pass it, and tackle the deficit post-midterms with a bipartisan commission. Fail, and Democrats will exploit the chaos, stalling Trump’s agenda.

History is watching. The bond market is teetering. Our politics are broken. But bold leadership—Trump’s vision, Musk’s genius, and JD Vance’s pragmatism—can forge a sustainable path. Pass the Big Beautiful Bill. Secure the border. Unleash growth. Then, together, slay the debt dragon before it consumes us all. The train is leaving the station—Team USA must be on board.

[1] 2023 House Homeland Security Committee report citing the Center for Immigration Studies

Nothing Stops this Train

The Unstoppable Train of America’s Debt: A Case for Bitcoin

America’s fiscal trajectory is a runaway train, barreling forward with no brakes, as Lyn Alden compellingly illustrates in her presentation, Nothing Stops This Train. The phrase, borrowed from Breaking Bad, captures the relentless, almost inevitable growth of U.S. federal deficits, driven by structural economic flaws and human nature. For readers of Sovereign Sunday, Alden’s analysis not only diagnoses the problem but also underscores why scarce assets like Bitcoin are increasingly vital in this fiscally dominant environment.

Historically, federal deficits correlated tightly with unemployment, spiking during recessions and easing in prosperous times. However, since 2017, this relationship has fractured. Deficits have ballooned to 6-7% of GDP, even with low unemployment, marking a new era of fiscal recklessness. This decoupling, Alden argues, reflects a system where traditional economic brakes—interest rate adjustments—no longer work. When the Federal Reserve raises rates to curb inflation, it paradoxically accelerates federal debt growth, as interest payments on the now-over-100%-of-GDP federal debt outpace any slowdown in private sector borrowing. The train, in short, has no brakes.

Why is this unstoppable? Two forces drive it: math and human nature. The mathematical problem lies in the Ponzi-like structure of the fiat system, reliant on perpetual debt growth. Total U.S. debt—public and private—exceeds $100 trillion, with only five years in the last century (1930–1934 and 2008) seeing nominal declines, each swiftly countered by monetary base expansion. The 2008 crisis, for instance, saw the monetary base surge from $1 trillion to $6 trillion to prevent deleveraging, shifting debt from private to public sectors. This system, leveraged 50-to-1 at times, cannot tolerate stagnation without risking collapse, forcing continuous credit expansion.

Human nature entrenches this further. Politicians face little incentive to cut deficits, especially with powerful voting blocs like baby boomers relying on Social Security, which is projected to deplete its $3 trillion trust fund by 2035. This demographic-driven expenditure, coupled with rising interest costs as rates can no longer structurally decline, ensures deficits remain entrenched. Both major U.S. political parties, despite their divides, agree on preserving these entitlements, making reform politically toxic.

This fiscal reality reshapes asset markets, particularly for scarce assets like gold and Bitcoin. Historically, gold prices tracked real interest rates (10-year Treasury yields minus CPI inflation), as investors weighed the yieldless scarcity of gold against abundant, yield-paying Treasuries. Since 2022, however, this correlation has broken, with gold soaring despite higher real rates—a sign of fiscal dominance overriding traditional dynamics. Bitcoin, too, defies expectations. Critics once dismissed it as a zero-rate phenomenon, yet it thrives at over $100,000 per coin despite hawkish Fed policies that broke banks. This resilience reflects a growing recognition of Bitcoin’s absolute scarcity and transparency, a stark contrast to the opaque, ever-expanding fiat ledger.

Alden’s message is clear: the U.S. fiscal train will keep running, likely for the next decade, with deficits unrelentingly at 7% of GDP. No election or policy tweak can meaningfully halt it. For investors, the antidote lies in owning high-quality, scarce assets. Bitcoin, with its fixed supply and decentralized integrity, stands as the mirror opposite of a system that prints units to delay collapse. As the fiat train accelerates, Bitcoin offers a hedge against the inevitable—a compelling case for sovereignty in an era of fiscal excess.

Here’s the full video with her excellent charts. Well worth a watch to understand what she/we mean when we say, “Nothing stops this train.”

Best of Twitter

Memetic Warfare

Parting Words….

That’s it for this week folks. Hope you enjoyed! -MK

Truly balanced and wise summation of our fork in the road. You are an inspiration!

Excellent Mike. Great write up and stellar memes.