Coinbase, Inflation & Our Great Experiment

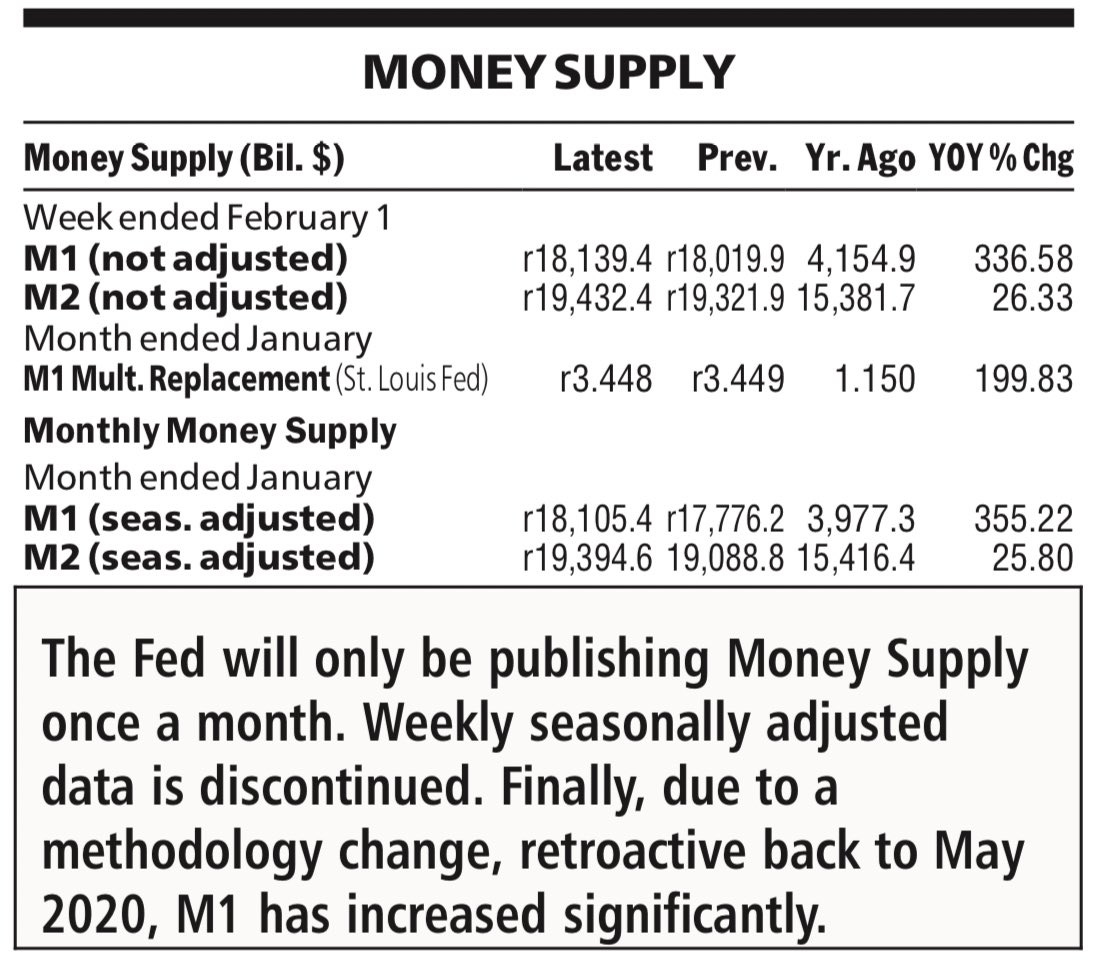

The Fed Ends Measuring Money Supply, aka Lies, Damn Lies, and Government Statistics

Still in Florida, funding startups, reminiscing with friends, and enjoying a steady diet of Sun, Steak and Steel that is good for the soul. While every week seems to be composed of about 3 months in our hyper-frenetic news cycle, here are a few important items I want to make sure you saw this week.

INFLATION & THE COINBASE IPO

The broader market and world is finally waking up to the idea that we’ve got massive inflation in the system. Not unexpected considering that 25% or more of all the dollars ever created in existence were printed in the last year. Inflation is an extremely difficult concept both to understand and measure. It’s difficult to grasp and masked by deliberately obtuse or false government statistics (for instance, the most popular inflation statistic cited by economists and government authorities is “inflation ex - “food & energy”, as if no one consumes those things….).

In any case, duration spreads are blowing out, meaning long term bonds are getting sold off (which makes their yield/interest spike - remember, a bond’s yield moves inversely to its price). The simple reason inflation smokes long term bonds, is because there is more risk to hold a bond for 30 years than for 1 year when the dollars you receive back in 30 years will be worth significantly less than they are today. Sure, you’ll get back $100 on a $100 bond, but that $100 will now buy you 3 dozen eggs, whereas in today’s money $100 will buy you 20 dozen eggs.

I’ll try to do a more comprehensive writeup next week on how bonds work (and why you have to be insane to buy them for long term periods, especially when half the nation is lending their money to sovereigns and others at zero or even negative interest rates).

The bottom line is, inflation can be devastating to lenders and consumers. Take a look at the Zero Hedge article below featuring Michael Burry’s opinion that inflation is back big-time. Burry was of course the star of The Big Short who pegged the housing bubble and ensuing financial crisis years before it actually happened. He sees a similar crisis with inflation on the horizon and has adapted the Twitter name Cassandra to warn us. Cassandra was a Trojan priestess of Apollo in Greek mythology cursed to utter true prophecies, but never to be believed. In a series of now deleted tweets, Burry makes the case that hyper-inflation is a possibility, and to ignore it at your own peril.

The thing you have to constantly remember and remind yourself - the economic and financial landscape we’re in can be summed up as One Great Experiment. Never in our history have we had such incredible government manipulation of markets, reporting statistics, debt, spending all while new and potentially massively disruptive exponential technologies like bitcoin are in the wild. Anyone who tells you they know how it ends is lying to you.

Coinbase

Coinbase has filed their S-1 with the SEC for direct listing on the NASDAQ noting $1.28B in 2020 revenue. Unlike many IPOs, they are profitable, with 43 million active users and an implied valuation of $100B. They also call out Satoshi Nakamoto as an intended recipient of the filing and list no company headquarters, being a fully remote company. Welcome to 2021.

For those that have been caught up or FOMO’ing the crypto fever, do yourself a favor and DON’T buy shares in the IPO. If you do, sell them on the first bump. There’s plenty of competition out there including better exchanges. Margins and valuation will likely come down, and smart investors seem to be sellers, not buyers at these levels (see article on Union Square Ventures selloffs).

The amazing thing is the valuation alone, over $100B means that Coinbase is more valuable than the Nasdaq, the NYSE and quite possibly every major exchange in the world. All built around investing in a technology that was mostly mocked by the professional investor class up until this year. It reminds me of the incredibly important concept of Infrastructure Inversion.

Infrastructure inversion is the idea that new technologies are initially built on old infrastructures, and they will be subpar and difficult to use until an ‘infrastructure inversion’ happens and they replace the old infrastructure.

Throughout history, the technology du jour always manages to plateau and comes up short in supporting the evolving needs of our technologically astute society. When this happens, there is typically a shift that takes place, an inversion of sorts where a new infrastructure is built to support the technologies of tomorrow. This typically takes place due to limitations of the present infrastructure that no longer allow for innovation. Humanity has seen this take place countless times over the years and it continues to happen at an even greater pace today. When the incumbent infrastructure reaches its potential, there is always a new technology that paves the way for a brand-new infrastructure, allowing for innovation and invention to flourish once again.

Think of automobiles replacing horses and getting stuck in muddy, dirt roads. Cars were mocked for awhile until it became clear it was a better solution and then roads were paved (new infrastructure for new technology) thus eliminating wheels stuck in mud and mockery of the, ‘electric horse’.

--------------

It is very likely that this decade we’ll see another great infrastructure inversion in finance. The routine will be the same. Entrenched cartels like the banks will resist. The banks will adapt. And finally, the banks will be running all of their traditional operations on top of a decentralized, trusted ledger. This will make traditional banking more efficient. At the same time, it will open up a door for many other applications.

For more on this topic, here is the last part of a speech I gave in 2018 to Stansberry Financial Conference in Las Vegas. Bitcoin was trading at $4700, and many of the salient points such as true scarcity, deplatforming and voting fraud that I spoke about then are even more relevant today. The title of the speech was, “How Going to Prison Just Might Make You a Better Investor (and Person).

The last lesson is, in some ways, the most important.

Humans need freedom.

I spent 15 months in that Pennsylvania prison. After that I was sent for 6 months to a Halfway House in the Bronx.

And if you’re wondering, one of the few places worse than prison…is a Bronx Halfway House.

The feeling of freedom is something that you can’t really appreciate until it’s been taken away from you.

I saw that in the little things when I got out…having a choice of food when ordering off a menu, or the ability to drink freshly brewed coffee…

But it also shows up in the big things. The ability to see and touch my children, to move freely and speak freely and live in the relative freedom that we enjoy… that’s an amazing experience. And we take it for granted, until we lose it.

Let me ask you:

How free are we today?

Well, of course in many senses we’re remarkably free. You often hear people saying we’re the freest country in the world, which isn’t quite true. Many other countries are freer than we are here: the Cato and Heritage Foundation rankings make that clear.

But in historical terms, we, in the West, enjoy more freedom than any other people at any other time in the history of the planet.

And that’s worth celebrating. I am so grateful for the freedoms I’ve been given, and the wealth that my generation has been given from the ones before us.

But we’re not yet as free as we can be… not yet as free as we should be.

There are still fundamentally flawed parts of our society, like the banking system and the criminal justice system, that hurt all of us, but especially those in the middle and lower class.

Here’s an example.

I was incarcerated during the 2012 Election and was one of about 3 people rooting for Mitt Romney - though not verbally rooting because I didn’t want to get stabbed, but rooting nonetheless. But the truly surreal part wasn’t the national election…but Colorado voting to legalize marijuana. While watching the election returns I looked to my buddy to the left of me – black guy, doing 5 years for conspiracy. Not even possession of marijuana, conspiracy to possess. To the right of me white guy doing 10 years for growing weed in his basement. We were watching an entire state say everything those two did was perfectly legal...but hey, enjoy the next 9 years of your life behind bars - NOW THAT’s not right.

Here’s one way it played out in my case.

I graduated near the top of my law school class. I worked at one of the top firms in the nation and… here’s my most important credential…for several years I religiously watched every single episode of Law and Order.

So you can understand why I deeply believed in due process and the concept of “presumed innocent” as a Constitutional tenet.

I also naively believed that when I checked my bank that the money I saw was my money.

So it came as a shock, that when I turned down the government’s “no jail no fine” deal, that they trampled the Constitution and went rogue.

Winning to them was more important than truth or justice.

The govt. employed tactics that would be more at home in the former Soviet Union than here in the US. They wiretapped phone calls between attorneys and clients. They even planted a bug in the bedroom of a husband and wife. I think if you’ve watched more than 2 episodes of Law and Order, you know that’s a shocking violation of the Constitution and our right to privacy.

They went even further and froze and then closed my accounts, and my wife’s business accounts, a particularly repellant move considering at the time she was the only one working and putting food on the table for our family.

The goal was to make it impossible to defend myself…or put me in enough pain that I would take their deal.

Is that freedom? Is that the rule of law?

Here’s what you learn after having your assets frozen and having to survive on mackerel packets for money.

Real liberty… real freedom… means the ability to control where, when, and why you spend your money. But in a centralized, cashless society, where every transaction is seen, analyzed and blessed, where we need ‘permission’ to plug into the system, how long before the government, or an algorithm can redline people for belonging to the wrong group or speaking the wrong way?

If you travel extensively, you’ll see that people in every other country intrinsically understand crypto. Whether it’s Argentina or China, people understand the giant twin risks of devaluation and confiscation.

We don’t get it. We’re blessed with a relatively stable currency, mostly because the dollar is the world’s reserve currency. So we print to our heart’s content without drastic inflation or devaluation.

Consider this though: we’re enjoying the strongest economy of our lifetimes. 4% growth with sub 4% unemployment, stock markets and real estate markets at all-time highs, tax receipts at an all-time high.

And even with all that, the deficit and the debt are exploding.

So what happens when we slow down?

We’ve officially given up on any notion of budget discipline.

So how do you protect your family and your portfolio? One way is Hard Money. And there’s nothing harder than Bitcoin. Think gold on 100 milligrams of Viagra. Totally removed from government control - and not subject to the temptation to PRINT. A true digitally scarce store of value immune to devaluation or confiscation.

The primary reason is Bitcoin’s constrained supply. Not only is it the most secure blockchain and network in existence, it is also limited forever to 21 million coins. That’s real scarcity. In fact, if every millionaire wanted to own just one bitcoin…they couldn’t. There are 36 million millionaires out there, and only 21 million Bitcoin.

And it’s not just a supply side story. When all is said and done, crypto and decentralization will impact nearly every aspect of the global economy.

But in some ways I think the disruption to markets is less interesting than the political and legal disruptions it’s bringing.

Remember the protests in Iran earlier this year? You’ve heard the stories of repressive regimes in places like Turkey and China; they would literally shut down the internet during upheaval to keep people from communicating.

Decentralization and blockchain are changing that. Blockchain tech is censorship resistant. So if one person is running a node somewhere, you can’t shut down the web. And so Dissidents can’t be silenced.

How about voting? Blockchain has the ability to eliminate voting fraud entirely. Now our politicians may not want to eliminate voter fraud, but if they did blockchain can take care of that before breakfast.

Crypto is going to make a lot of people richer. Like it not. Regardless of what governments try to do.

In just the same way, crypto is going to make a lot of people freer.

And there’s nothing anyone can do to stop it. Just ask China — which banned crypto for the 4th time last year — how successful that’s been.

So why has the uptake seemed so….slow? Why are the skeptics so loud?

I think there’s a simple answer.

Twitter.

Attention spans these days are measured in seconds and 140 characters; and anything that doesn’t happen instantly seems glacial.

But remember crypto has been around less than a decade, and we’ve only just begun to see what it can do.

There’s a concept known as infrastructure inversion - when one technology comes along to replace an old one, it’s usually not immediately obvious how it will all work. Until the existing infrastructure catches up, these new concepts will mostly be greeted with fear and laughter.

History is littered with examples: trains, cars, the Internet, cell phones. All these advancements were initially dismissed as nonsense.

I'm old enough to remember when “internet was only for porn” and “only a doctor or drug dealer would ever carry around a cell phone?”

What about downloading music? Napster was a complete pain in the ass, likely 'illegal and for tech nerds' only. Now if that doesn’t sound like crypto, nothing does!

But, that was before Apple and Steve Jobs, another great innovator.

People are skeptical about Crypto Assets not because they’re unimportant, but because they’re new and complex.

That leaves a lot of money on the table for those of us who have a little more vision and are willing to do a little more work.

I’d put it like this: would you rather buy Amazon when it was trading in the single digits – when Barron’s and the rest of us on Wall Street were calling it Amazon DOT BOMB? Or wait until it clearly dominates every industry and trades for 1000x higher. That’s the analog before us today with Bitcoin.

Crypto Assets are brakes on the abuse of power by the state and big corporations.

They’re the first serious de-evolution of financial power back to the people....not upward to the state or corporations, which is where it's gone for the past 100 years, but downward back to us.

Bitcoin and blockchain are our generation’s chance to disrupt and leave the world freer than we found it.

It’s been a long time since that happened, isn’t it?

Articles I’m Reading…

**Michael Burry expecting Weimar Germany (post-WW1) levels of inflation in the US

**Top five take-aways from upcoming Coinbase IPO

**Applying the concept of economic and business moats to our personal lives

**Why Information Asymmetries Matter, and how profitable they can be. New crypto projects and startups can be Asymmetric opportunities, giving you the chance to get in on a project before the public knows about it and raising value just by increasing awareness.

**In study of 26 students on mediation, mindfulness training was most effective at increasing de-centering and self-transcendence. Students were more connected to others and their surroundings upon completing meditation.

**Are you ready for the ‘Great Reset’? Special Drawing Rights (SDRs) are on the rise, and expected to be issuing out more than 10 times what was issued in 2009.

**Sen. Rand Paul’s great exchange with Dr. Levine on ethical dilemmas in administering sex-changing procedures to minors.

**A short, very good essay summing up the last 4 Years in case you were in a coma and missed it.

**Oldie but goodie from Malcolm Gladwell. When underdogs choose not to play by the rules, they can win. Even when everything we think we know about power says they shouldn’t.

**Planning a Personal Retreat. Nothing new here, just a solid reiteration that communing with nature and finding some solitude has to be an intentional feat. It’s one of the pillars I personally coach on and becomes more crucial each year in our age of constant stimulation and deliberate dopamine harvesting from outside forces. Go alone, go with a lover, or go with your children. Just go.

Charts of the Week

Government Close to Responsible for 30% of ALL American Income (terrifying)

Videos I’m Watching...

Andrew Torba and Steve Bannon discuss Transhumanism - How the Silicon Valley elite consider themselves a superior race

This is not Tom Cruise. But #deepfake technology is so good now, think of the implications when we can’t actually tell if someone actually is someone...

Books I’m Reading…

21 Lessons: Great book for the beginner-intermediate Bitcoin-curious investor.

Twitter Octagon…

Parting Words…

“The “death” of the Hero is the “death” of boyhood, of Boy psychology. And it is the birth of manhood and Man psychology. The “death” of the Hero in the life of a boy (or a man) really means that he has finally encountered his limitations. He has met the enemy, and the enemy is himself. He has met his own dark side, his very unheroic side. He has fought the dragon and been burned by it; he has fought the revolution and drunk the dregs of his own inhumanity. He has overcome the Mother and then realized his incapacity to love the Princess. The “death” of the Hero signals a boy’s or man’s encounter with true humility. It is the end of his heroic consciousness.”

― Robert L. Moore, King, Warrior, Magician, Lover: Rediscovering the Archetypes of the Mature Masculine

This passage highlights one of the biggest issues men face today.

Too many men today have either been robbed of or have avoided meeting their own darkside.

This has essentially lead to a mass of men walking around with boyhood psychology well into their later years.

If your interested in the truth found in archetypal energies, read it, then read it again, then journal about it.” - Unknown