Squeezing the last bit of Summer out. Here’s a few tidbits to ponder. Will see you next week back in the turret!

Tucker’s podcast with Adam Corolla is certainly worth a watch.

The two most important points he raises are a potential hot war with Russia, and the slippery slope that may lead to Trump being assassinated by the Deep State.

The Trump point is obvious. The current regime (and Deep State) is doing everything possible to prevent Trump from running for President in 2024, or being elected. They’ve now indicted him on 4 separate cases and the Mockingbird media and deep state have done everything possible since he won in 2016 to minimize and pigeonhole him.

If these cases fail to stop Trump running for President, the next logical choice and perhaps final option may be to assassinate him, just as they did with another President who bucked the CIA and military industrial establishment back in the 60s.

The hypothetical is not farfetched. As I’ve written repeatedly, we are at the End Game and one side’s unprecedented undemocratic and unconstitutional efforts to interfere in the election means it’s Win or Go to Jail time for both sides. Recently, Trump has escalated his rhetoric, pledging to hold accountable those he considers to be engaging in criminal activities. Faced with the possibility of imprisonment or even harsher consequences, would such individuals limit themselves to merely pursuing indictments to achieve their objectives?

Here’s Tucker’s summary of the obvious trajectory:

“If you begin with criticism, then you go to protest, then you go to impeachment, now you go to indictment and none of them work. What’s next? Graph it out, man. We’re speeding towards assassination, obviously. … They have decided — permanent Washington, both parties have decided — that there’s something about Trump that’s so threatening to them, they just can’t have him,” Carlson said in the interview, which was posted online Wednesday.

The FBI has executed two Americans without due process in the last 2 weeks without any consequences. Why do you think they would do anything different when it comes to Trump?

Brief Twitter Clip of Tucker re: War with Russia.

With regard to Russia, it’s the same thought process above that would lead to a hot war. In 2020, the Regime fabricated a once in a century pandemic that was so dangerous (despite a 99.95% survival rate WITHOUT treatment, and virtually a 100% survival rate with treatment unless you were incredibly old or obese) that it required mass mail-in ballots, a formula for widespread fraud and cheating that helped push Joe Biden over the top.

In the last few weeks, it’s clear they’re trying to run the same playbook. However, many people, who either have experience with past events or can interpret the data, are no longer as concerned about Covid as they once were. They are less likely to readily accept measures like masking, lockdowns, mandatory vaccinations, or widespread use of mail-in ballots again.

When the Regime sees their efforts to reinstate Covid Scamdemic Part Deux have failed, the logical choice to upgrade authoritarian control is a kinetic war of some sort that requires martial law, or some other type of extraconstitutional measures to combat our ‘mortal enemy’ Russia (or the ‘domestic terrorists’ boogeyman) are the logical targets.

Be wary of both of the above scenarios. Tucker and others voicing them out loud and letting the Regime know that we are onto them, it makes it less likely that either will happen.

Here’s the full podcast for your viewing pleasure.

What I’m Reading and Watching….

The SEC got sternly reprimanded by a Federal Court over its arbitrary refusal to convert Grayscale’s Bitcoin Trust to a Bitcoin spot ETF.

This could potentially open the door for a spot bitcoin ETF in the U.S - even as the SEC has disapproved every such ETF application it's reviewed to date.

While the recent decision suggests that the approval of a Bitcoin spot ETF is increasingly probable in the near term, the timing remains uncertain. SEC Chairman Gensler has been criticized for running the agency in a manner that prioritizes his personal opinions and grievances over clear regulatory guidelines. The most optimistic estimate for approval could be the first quarter of 2024. Ideally, multiple ETFs should receive approval simultaneously to level the playing field.

There are around seven promising ETFs that have been waiting for approval, some for an extended period. For example, the Winklevoss twins submitted their first application as far back as 2013. By greenlighting several ETFs simultaneously, the SEC could mitigate the substantial first-mover advantage that a single approval would offer. This would also likely drive down fees, making providers compete for retail investors. Currently, Grayscale's GBTC product charges a steep annual fee of 2%, whereas fees for index or spot ETFs should ideally be under 1%.

For those that are curious about how and where to position themselves from a portfolio standpoint over the next few months and years, you may want to look beyond the daily headlines about Bitcoin and focus instead on the following key points:

Blackrock and the biggest asset managers on Earth are positioning to be key players in the sector going forward. The SEC and other bagholders for Wall Street have done their best to disrupt and suppress the sector in order to allow their friends (and future employers) to enter the market at a more favorable price point compared to previous record highs.

Smart money doesn’t like buying at the top. They like to buy things at a deep discount, and are not above creating their own FUD (fear, uncertainty and doubt) in order to send prices lower where they can accumulate the necessary size before the next big up move.

Bitcoin supply is constrained by immutable code. There are only 21 million bitcoin in existence and that’s all there will ever be. Hedge funds, investment banks and asset managers like BlackRock were uncharacteristically late to the Bitcoin phenomenon (trustless, stateless, censorship resistant money that can’t be debased) and would much rather fill their bags at $20K than $65K. That’s precisely what they’ve been doing for the past year and will continue to do.

Around April of next year, Bitcoin is scheduled for another "halving," a built-in algorithmic event that reduces the number of new bitcoins miners receive for verifying transactions and securing the blockchain. Currently, miners are rewarded 6.5 bitcoins per block, but this will drop to 3.125 bitcoins after the next halving. This effectively reduces the rate at which new bitcoins enter the market. According to basic economic principles, when supply decreases while demand remains the same or increases, the price is likely to rise.

Historically, Bitcoin's price has shown a tendency to increase around the time of its halving events. You have approximately six months or less to establish a position before the likelihood of the price climbing further. The only potential obstacle to this upward trend could be a severe recession brought on by elevated interest rates and tightened liquidity, something the Federal Reserve has been aiming for to curb inflation. It's uncertain whether their efforts will succeed. If they do, Bitcoin's price could remain stagnant or even decline for an extended period, offering more time for accumulation. However, once the Fed eases its restrictive policies, Bitcoin is likely to experience significant price appreciation.

For my price target and more investing thoughts and writing on money, markets & investing, be sure to follow me over at Alpha360.

Beginning next week, I will be offering insightful market & investing based thoughts and updates. If you like how Sovereign Sunday breaks down the key events you need to know in a concise and no BS manner, you’ll love what Alpha360 does for markets, money and investing.

Here’s a good summary from Alex Berenson why the MRNA covid shots are different from other vaccines. Worth a read.

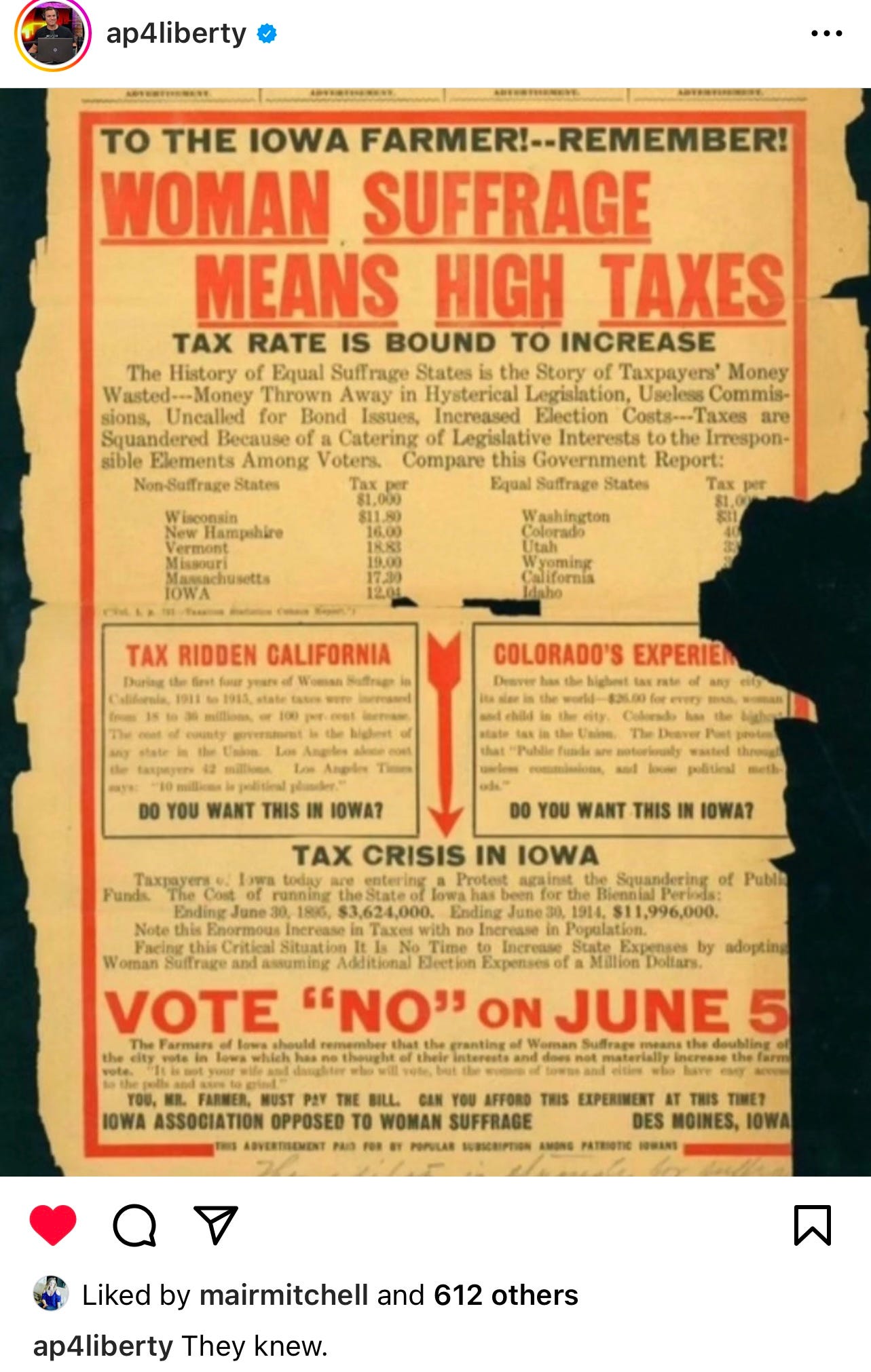

Best of Tweeter

Memetic Warfare

Parting Words….

That’s it for this week folks! Enjoy the holiday and I’ll see you next week. As always, smash the like button up top and share it with a friend. Vires in Numeris.